The “Internet of Value”: 8 Top Sectors Being Transformed by Blockchain

A new industrial era

“We’ve had a few decades of the Internet of Information. Now we’re getting to the Internet of Value,” said Don Tapscott, CEO of the Tapscott Group, as he began his keynote presentation at the latest IBM InterConnect conference.

We’ve been through three industrial revolutions: the first with mechanization, water power, and steam power; the second with mass production, assembly lines, and electricity; and the third with computers and automation.

According to Don, we are in the midst of the fourth industrial revolution. This shift into cyber physical systems is “infusing technology through every organization, every business process, the economy, the business world, even through our bodies.”

This evolution has brought about new advancements that will “participate in the transformation of corporations, of competitiveness, and of our economy.” More importantly, it has also brought about a new commercial and transactional platform needed by these technologies—blockchain.

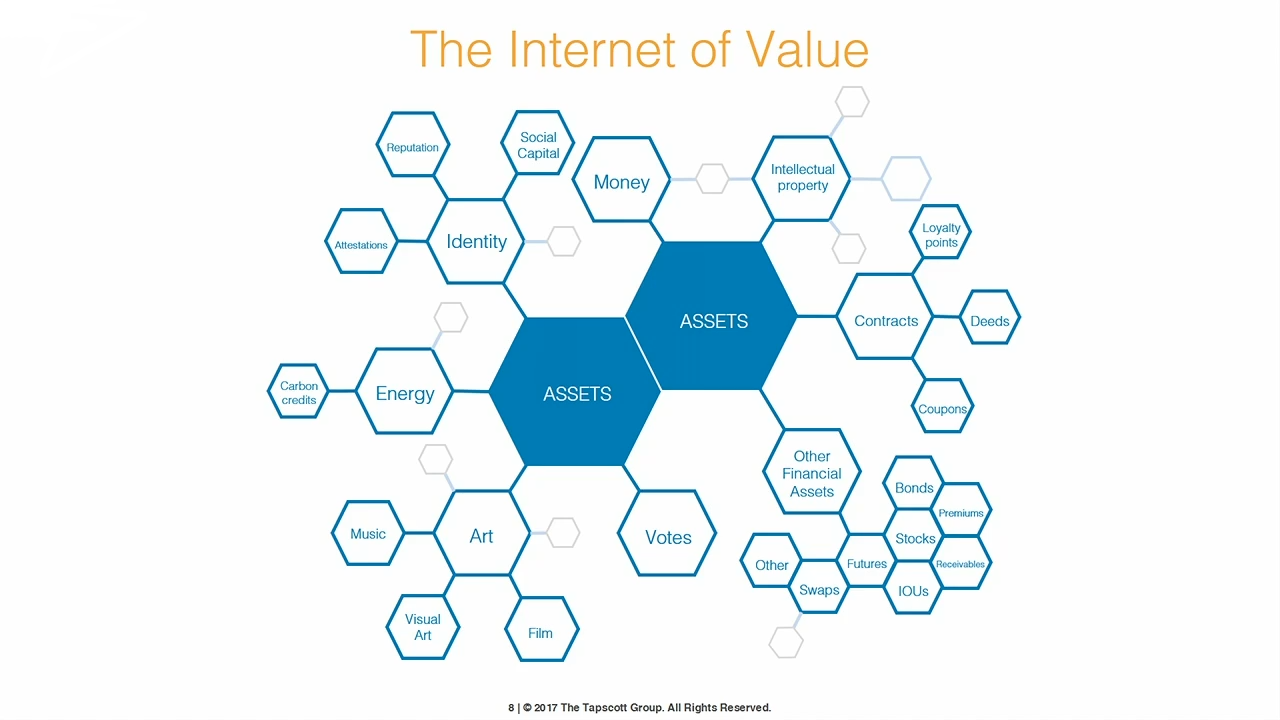

The Internet of Value

“Wealth creation, corporations, and innovation rely not just on information but on things of value—assets,” said Don as he explained how transactions are traditionally processed. “If I send you a hundred dollars, it’s really important that I don’t have the money (anymore) and I can’t send it (again to someone else).”

In that scenario, Don is describing a problem known as double spend. This is a problem that’s mitigated by having transactions go trough large intermediaries.

Intermediaries include financial institutions, governments, and social media organizations. All of these companies “provide the basic transaction logic for every type of commerce. They enable the clearing and settling of transactions, they keep records, and they enable us to trust one another because we have no peer-to-peer medium of value.” However, as Don points out, this solution has its own set of problems:

- Security. Intermediaries big and small can be hacked.

- Efficiency. Intermediaries use archaic and slow processes that bog down transactions. “It can take days for money in computers to move down the streets of a large city even weeks for some kinds of assets.”

- Fees. Intermediaries take a cut out of each transaction.

After all these problems, Don pointed out another key issue in that intermediaries “don’t have the wherewithal or the capability to include everyone in the financial system and overall they’re capturing our data.”

“We have this crazy situation today where there’s wealth creation, but throughout the developed world, there’s declining prosperity.” —Don Tapscott, Tapscott Group

According to Don, all of these issues are at the “heart of all of the anger, populism, and extremism that exist today.”

“What if there were not just an Internet of Information, but an Internet of Value? Some kind of global, vast distributed ledger that runs on millions of computers all around the world and that would enable anything of value to be stored and transacted in a secure way?”

—Don Tapscott, Tapscott Group

Transaction costs near to zero

“(Blockchain) gives intermediaries a powerful new tool because it enables people and organizations to trust each other, to transact, and to do business peer-to-peer,” said Don. “The intermediaries are being forced to transform their game.”

“Trust is not achieved by some powerful institution. it’s achieved by cryptography, collaboration, and by some clever code. We call (blockchain) the trust protocol.” —Don Tapscott, Tapscott Group

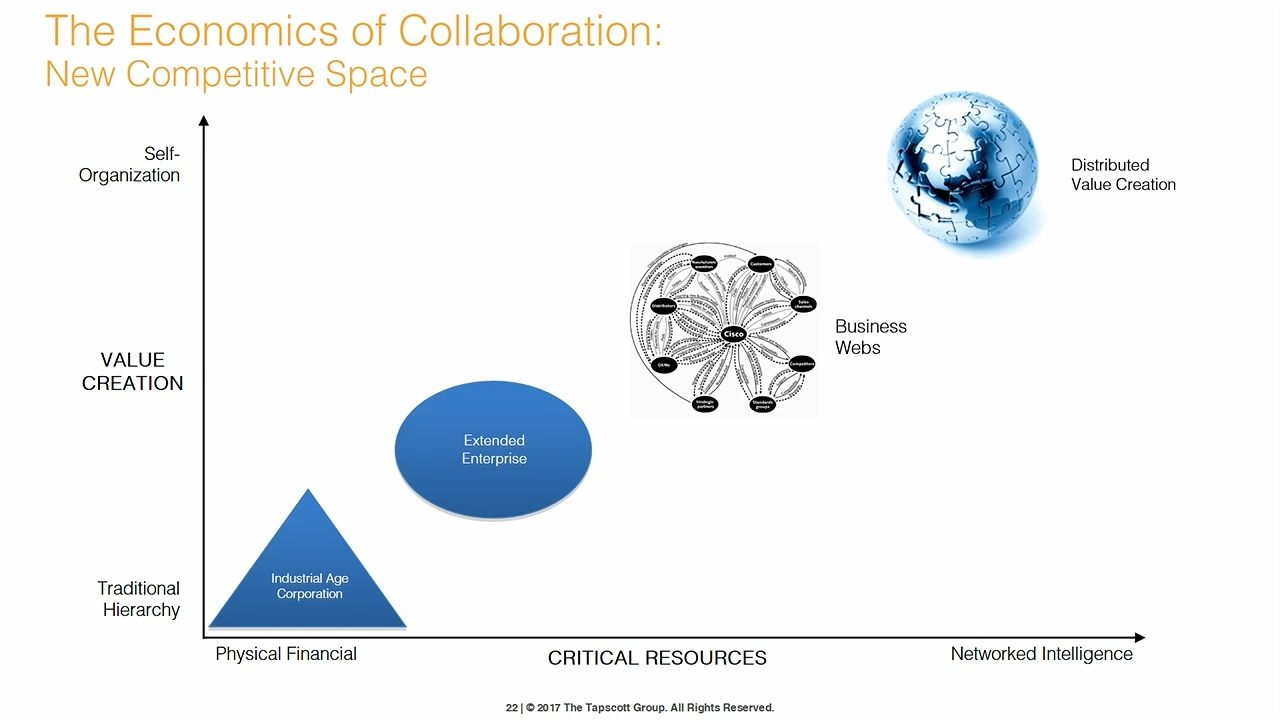

What’s so important about blockchain? To answer this question, Don said we have to take a look at competitiveness and why firms exist. He referred to an economic theory proposed by the late Ronald Coase in 1973. All of these boil down to one thing—transaction cost:

- The cost of search in the open market is prohibitive.

- The cost of coordination and getting people who’ve never worked together before is a barrier.

- The cost of contracting can be exhaustive if every little activity required a contract.

- The cost of establishing trust can be difficult since trust is an issue.

According to Don, blockchains are already affecting all the four categories of transaction costs. “This is going to lead to a very profound change in the deep structure and architecture of a corporation,” he said.

This brings us to distributed value creation with “a trust protocol implemented across enterprises and across the economy, where these transaction costs in some cases can drop to almost to zero.”

8 main sectors transformed by blockchain

Previously, we’ve written how blockchain is already affecting multiple industries today. To continue that trend, Don outlines eight business models, where blockchain sees value.

First off are blockchain cooperatives for sharing economies, such as Uber and Airbnb. These are service aggregators and not sharers, as Don explained, but the potential for blockchain remains.

“Everything the company, Airbnb, does could be done by software. It’s a database,” said Don. “By putting the same service on a blockchain, all the usual transactions simply have to be converted into smart contracts. This will turn room owners into a cooperative, negating the need for an intermediary and it’s fees.”

Blockchains can help rights creators or content creators get compensated. In this scenario, Don explained how a music artist can use platforms, such as Mycelium, to place songs in a blockchain. Using the song in any way from simply listening to it to using it in a big production calls on smart contracts that collect and transfer varying fees to the creator.

This same idea applies not just to musicians but to any content creator.

Another application of blockchain is for re-intermediation. In the case of remittances, the transfer of money by a foreign worker to an individual in his or her home country, intermediaries will charge roughly 10% of the total value being sent. There’s also the issue of the time spent having to go through an intermediary to send and receive the money.

Transactions such as these are made simple by blockchain applications, such as Paycase, which enable the transfer of funds in mere seconds instead of days with a lower cost of transaction.

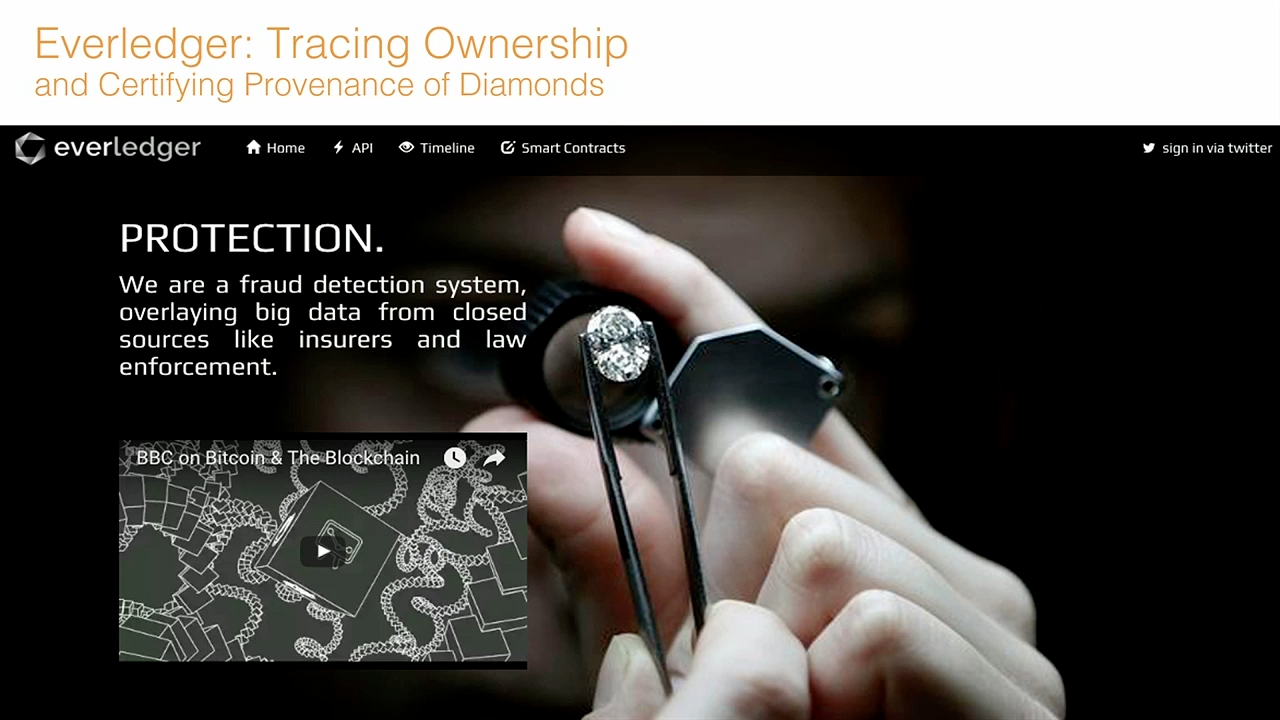

Outside of finance, blockchains also have value in supply chains where it’s very important to have provenance of all assets. A good example for this case is Everledger, where over one million diamonds are now registered and its blockchain has expanded to other luxury goods, saving insurers $50 million annually.

Blockchains will also have a place in the continued development of the Internet of Things (IoT).

“We’re animating the physical world and all of these devices will not just be collecting information, monitoring, and changing our environments for us,” said Don. “A lot of them will be doing transactions. This is natural application for blockchain.”

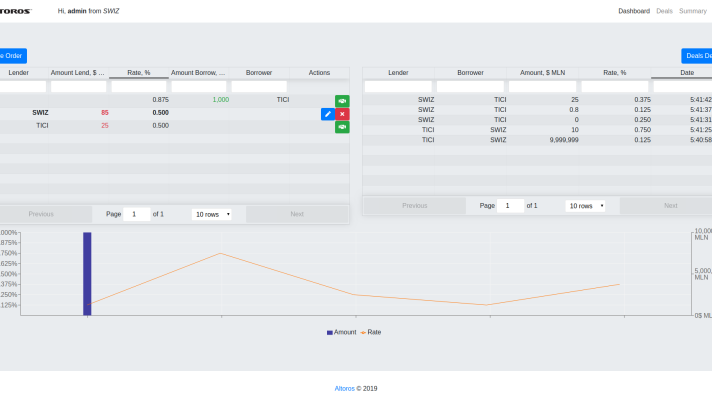

Blockchains are already playing an essential role for platform builders, specifically in financial institutions. According to Don, traditional financial institutions are built much like Rube Goldberg machines in that deliberately complex processes are used to perform the simplest of transactions.

Using blockchain, financial institutions have the opportunity to streamline all of its processes such as:

- Authenticating and attesting value

- Transferring value

- Storing value

- Lending value

- Exchanging value

- Funding and investing

- Insuring value and managing risk

- Accounting for and auditing value

“This is an opportunity to think strategically and enter into other businesses.”

—Don Tapscott, Tapscott Group

There’s also potential for blockchain in better data management. According to Don, data that we create is being fracked much like oil and gas. This aggregated data is creating something of extraordinary value.

“Facebook is the ultimate example of a fracker. This is a problem because we create this asset but somebody else gets to own it,” said Don. “We leave this trail of digital crumbs that are being collected into mirror images of ourselves that constitute our identities.”

This is an issue of lost privacy and it’s something blockchain can resolve. There are companies such as SecureKey that are working towards developing digital identity on a blockchain.

Last is the application of blockchain to improve public sectors. Governments all over the world have already seen what blockchain can do and are in the process of adoption. Dubai has tapped IBM Blockchain to help execute it’s 2020 blockchain strategy. Sweden is putting its land registry on a blockchain. Nasdaq is leading blockchain govtech developments in Estonia. The list goes on.

“We are in a new paradigm,” concluded Don. “New paradigms are nearly always received with coolness, even mockery, or hostility. Those vested with interests fight the change,” he said. “The shift demands such a different view of things that established leaders are often last to be won over, if at all.”

As technology leaders in this era of blockchain, Don urges us to educate, get involved with development, hone IT talent, and further investigate the implications blockchain will have.

Want details? Watch the video!

Related reading

- A Close Look at Everledger—How Blockchain Secures Luxury Goods

- Blockchain Security: Choosing a Platform Is Only the First Step

- The Journey to a Self-Sovereign Digital Identity Built on a Blockchain

- Blockchain for Trade Finance: Real-Time Visibility and Reduced Fraud