Governance Is a Critical Need and a Critical Weakness of Blockchains

The four key blockchain layers

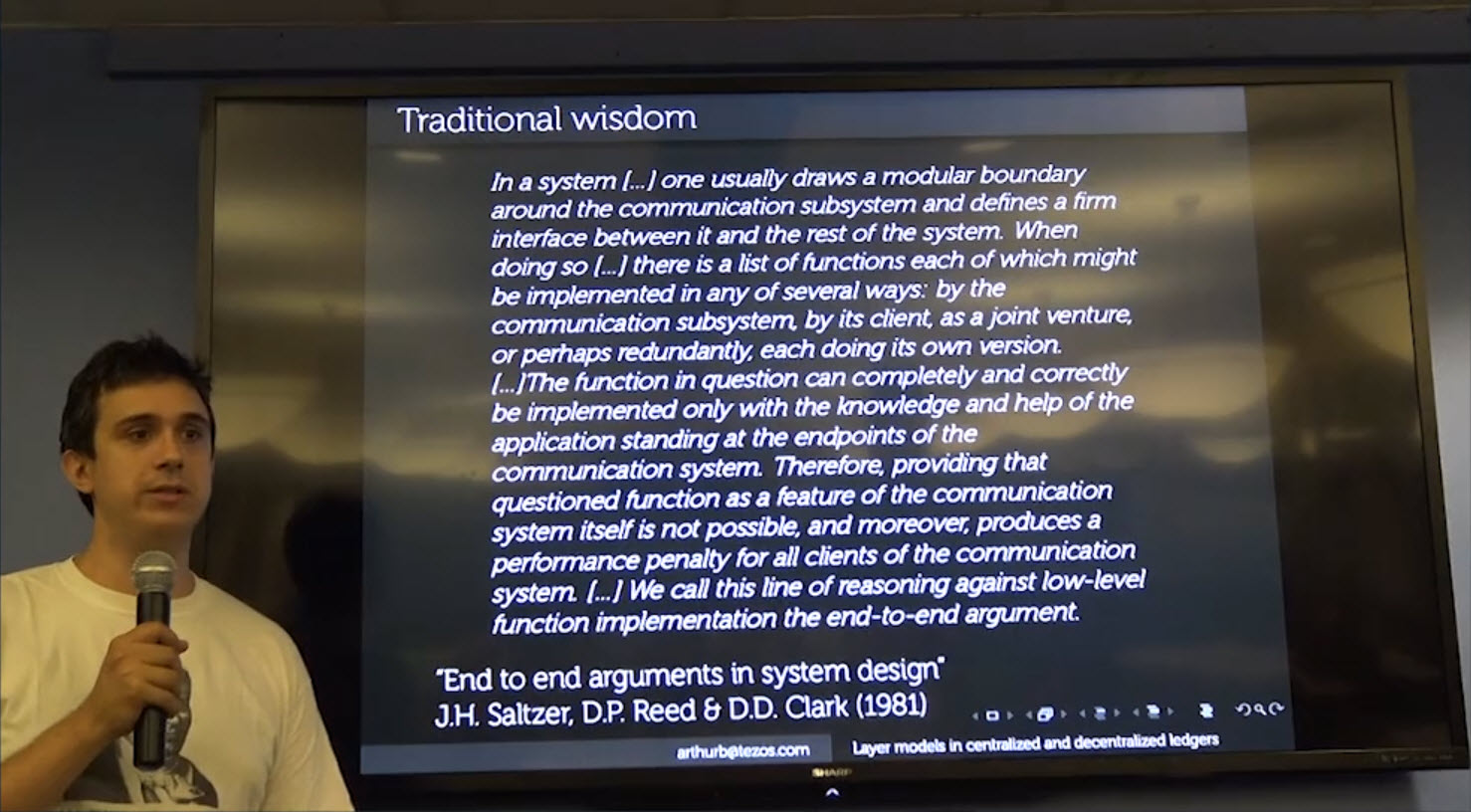

The recent hard fork of the Ethereum blockchain and the ongoing block-size debate within the Bitcoin world have focused Arthur Breitman’s mind.

Arthur Breitman

Arthur is a founder and a senior software engineer with Tezos, which calls itself the world’s first self-amending ledger and which is scheduled to be launched in Q1 2017. He gave a presentation at a recent Hyperledger meetup in Silicon Valley, speaking of the current blockchain landscape.

“I’m a blockchain realist,” Arthur said, “I think they’re very cool but also a little overhyped.”

Before discussing centralized / decentralized blockchains, the advantages, and problems therein, he gave a brief overview and some key technical details of the four key blockchain layers:

- network (wire protocol)

- consensus

- transaction

- application

The network and transaction layers

When speaking about the network layer, Arthur pointed out that it ensures communication between the nodes and typicaly represents a gossip network. The issues to handle within this layer were enumerated as follows:

- DDOS

- synchronicity

- scalability

According to Arthur, traditional innovation is possible at this very layer.

Then follows the transaction layer that defines the semantics of the ledger. Arthur outlined that this layer has more to offer than just “transactions”, e.g. it can:

- originate a contract

- issue an asset

- create an identity

Though introducing first-class semantics requires consensus, the derived semantics is still possible at the transaction layer.

The consensus and application layers

The consensus layer determines a canonical version for the state of the ledger. It has a number of models:

- traditional BFT algorithms (PBFT, Zyzzyva, and HB-BFT)

- proof-of-work (Nakamoto Consensus)

- proof-of-stake

Within this layer, innovation is harder in existing systems, requiring consensus.

Arthur advocated throughout his presentation for making the first three of these layers “as thin as possible, with a rich application layer that does as much as possible.”

So, the application layer is built on top of the ledger, using its underlying functionality:

- wallets

- notary services

- merchant services

- ledger visualization

He highlighted that innovation in here is easy, particularly in permissionless environment.

However, even the coolest applications won’t work in blockchain “unless everyone agrees to what is going on,” he said.

“Don’t use it as a decentralized or distributed database (for example). In fact, you should treat transactions (simply) as data operations, with no semantics at all. There should be a complete abstraction in which the blockchain has no idea of value, but just has information.”

—Arthur Breitman, Tezos

Challenges in decentralized ledgers

Speaking of Hyperledger, Arthur noted there is not the consensus problem associated with Bitcoin and Ethereum, because the idea is to have a set of known parties and trusted validators within a closed, permissioned system. On the other hand, “you do need a rich transaction protocol if you have a decentralized ledger,” he noted.

He outlined that decentralization is achieved by entangling the transaction and consensus layers. Consensus is therefore achieved with pecuniary incentives. So, the challenges brought along by thin transaction layers are the following:

- dilute the value of the token

- present scalability challenges (less concise)

- may fail to build network effects

- essentially parasitic

How centralized ledgers make a difference

Talking centralized ledgers versus decentralized ones, Arthur accentuated that decentralization didn’t necessarily imply “permissionless” environment, while centralization didn’t imply “permissioned” one. Still, centralized ledgers can be tamper evident.

“Number one feature of decentralization is censorship resistance.” —Arthur Breitman, Tezos

Concerns about censorship and interference from third parties (especially including governments) have been raised since the earliest days of Bitcoin, but may be of less concern with a centralized blockchain, Arthur said. “If your application doesn’t care about a concerted, global effort of governments to stop it, then you have can have a centralized network and it will work beautifully.”

Examples of this kind include financial contracts between and among established financial institutions, tracking of appliance warranties, and land registries, he said.

Arthur exemplified why thin transaction layers make sense in such a case:

- scalability is less of an issue

- no issues with token value

- facilitates innovation

Arthur summed it up saying that Hyperledger should strive for a thin transaction layer and build modular, swapable transaction semantics.

Governing the governance

Although he noted some key challenges with decentralized ledgers (such as scalability and a failure to produce network effects), Arthur returned to this theme that governance problems present the real hazards.

He noted how the recent Ethereum fork “was a governance decision that happened behind close doors” and how the Bitcoin block-size “blunder” (in his word) is far from resolved. The idea of “meta-consensus capability” within the Tezos project addresses governance issues, he said. The company’s website says that “Tezos not only comes to consensus about state, like BTC or ETH. It also comes to consensus about how the protocol and the nodes should adapt and upgrade.”

Blockchain is still chaotic

If human beings were better wired to be trustworthy, blockchain would be moving forward much more quickly. Of course, most societal ills would also cease to exist. Due to our species’ potential for mischief, the world of blockchain still appears very chaotic.

Despite Bitcoin having been around now seven to eight years, we’re still in the very early moments after the Big Bang it created. Tezos is taking an intriguing new direction, particularly in the world of decentralized blockchain.

At the meetup, Arthur did a great job in outlining and balancing the relative strengths and weaknesses of each. We look forward to the Tezos launch early next year, at which point we can thoroughly evaluate the idea of self-amending blockchains and how effective this approach will be in practice.

Want details? Watch the video!

Table of contents

|

Related slides

Related reading

- Fireside Chat: Blockchain Security, Scalability, and Energy Consumption

- The Royal Bank of Scotland Builds a Hyperledger Digital Wallet: the Lessons Learned

- Opinion: The Impact Blockchain Can Bring upon Finance and Banking and How It May Happen

- Managing Risk and Building Trust for Blockchain in Finance

About the speaker

This post was written by Roger Strukhoff and Sophie Turol, with assistance from Carlo Gutierrez and Alex Khizhnyak.