Canadian Financial Institutions Are Adopting Blockchain: 6 Success Stories

Home to plenty of blockchain startups

There’s been plenty of talk around blockchain specifically in the finance industry. The recently concluded IBM InterConnect 2017 conference only served to strengthen that hype.

During the conference, Manav Gupta, Curtis Miles, and Dan Selman of IBM led a session on blockchain adoption among Canada’s financial institutions—large and small. The session included an introduction to blockchain, Hyperledger Fabric, and Fabric Composer.

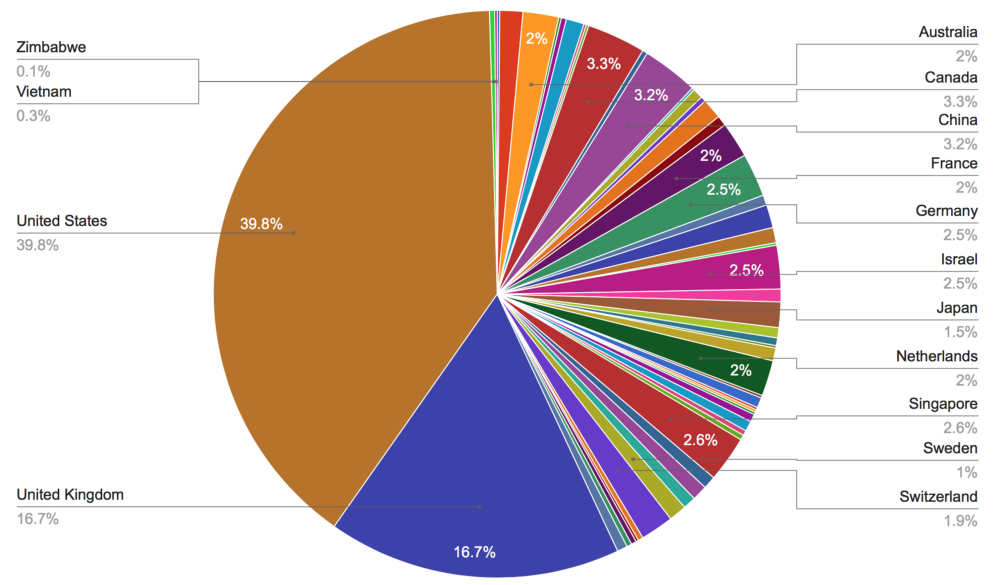

According to the presentation, blockchain startups are primarily centered in the United States and the United Kingdom with both nations housing 39.8% and 16.7% of blockchain innovators respectively. Third on this list is Canada, playing host to 3.3% of global blockchain startups.

Source

SourceAt the same time, leading the Canadian blockchain charge are its large financial organizations. Here, we’ll highlight six successful attempts to adopt the technology among the country’s big industry players.

“We have a lot of groundbreaking work happening in Canada.” —Manav Gupta, IBM

Successful trial encourages adoption

Scotiabank, headquartered in Toronto, recently announced a successful blockchain trial using AlphaPoint’s Distributed Ledger Platform (ADLP). Trade reports were submitted to a deployment of the ADLP as part of the multi-month project.

“Distributed Ledger Technology enables institutions to rethink how data flows within their organizations. Partnering with Scotiabank is an amazing experience. Their team is leading the charge by proving out pragmatic, near-term implementations of this revolutionary technology.”

—Joe Ventura, AlphaPoint

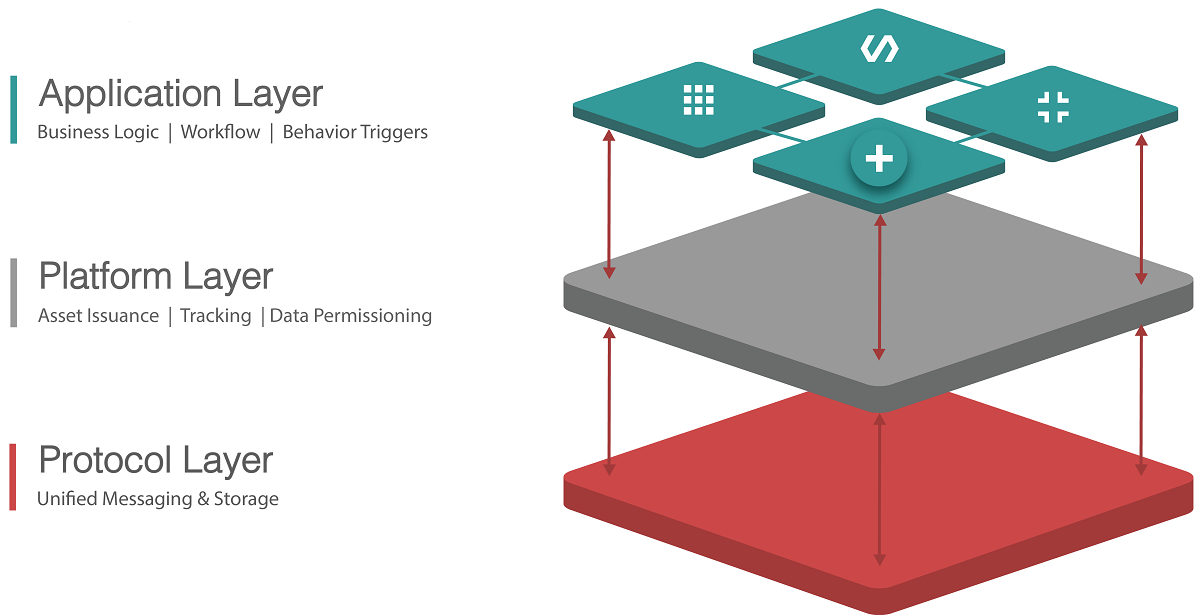

Image credit

Image creditThe ADLP integrates with existing financial infrastructure and other blockchain implementations. Some of its features include:

- Cryptographic auditability of all platform activity

- Functions as a permissioned-access blockchain on secure enterprise network

- Rigorous, customizable permissioning logic

- Integration gateway for existing financial protocols

- Flexible, application-specific rules for consensus

The platform runs simultaneously on Microsoft’s Azure cloud and AlphaPoint hardware. While no specifics on the future of the collaboration have been announced yet, AlphaPoint is confident about the future of blockchain in the finance industry.

Dan Selman of IBM emphasized the importance of blockchains being able to integrate with existing systems.

“At some point, you’re going to get data onto the ledger and off the ledger. There’s going to be integration technology somewhere. You’re going to have existing systems of record and you’re going to have to wire those into the blockchain.” —Dam Selman, IBM

Faster rewards programs

The Royal Bank of Canada (RBC), the country’s largest bank, continues on its mission to improve its customer rewards program using the blockchain technology. The bank began this project late last year with the resources available to the blockchain consortium led by R3CEV, which it is also a member of.

Reward programs are just one of the methods banks can use to encourage customers to keep on using credit cards. However, with the current technology, it usually takes weeks before points earned through a transaction today shows up on a user’s account. With blockchain, this changes as transactions are able to processed in near real time.

No specific dates have been announced as to the project’s culmination though the bank has hinted at a release some time later this year. RBC is also looking at other avenues outside of the rewards program, where blockchain can see use.

“We’re all trying to figure out what it means. If Steve Jobs had tried us to tell us everything the iPad could do, we wouldn’t have understood it.”

—Linda Mantia, RBC

Cross-border transfers

Canadian Imperial Bank of Commerce (CIBC) has formed a strategic alliance with National Australia Bank (NAB) and Israel’s Bank Leumi to reduce costs and speed up innovation. Through the alliance, the banks will be able to share proprietary information with the goal of co-developing digital and mobile products and services.

Last year, CIBC and NAB conducted blockchain tests. Money was transferred from Canada to Australia and back using Ripple, effectively performing a cross-border transfer. This is simply one of the ideas that the alliance are looking to expand development on. The collaboration is expected to focus on four points:

- cybersecurity

- digital and mobile banking

- financial technology

- payments technology

“At the end of the day, the alliance will be deemed successful because we really helped further each other’s innovation strategies at a faster rate.”

—Stephen Forbes, CIBC

Digital identity management

Canada’s largest banks including Bank of Montreal, CIBC, Desjardins Group, RBC, Scotiabank, and Toronto-Dominion Bank are also exploring the use of blockchain to power a digital identity network. The collaboration is being done with IBM and SecureKey Technologies.

Still in the testing phase, the blockchain network will enable users to confirm the details of their identity through a mobile app. This will make it more convenient to sign up or access services, removing the need to sign documents or provide identification in person.

IBM participates through the use of its Blockchain service, which distributes information across a network of computers provides security to the system, making identity theft difficult to pull off.

“We didn’t want to have a piece of hardware or software in the middle where customers’ private data is running through. We didn’t want to create honeypots of data, where all the data went to one place.” —Greg Wolfond, SecureKey Technologies

Lessons learned by the Bank of Canada

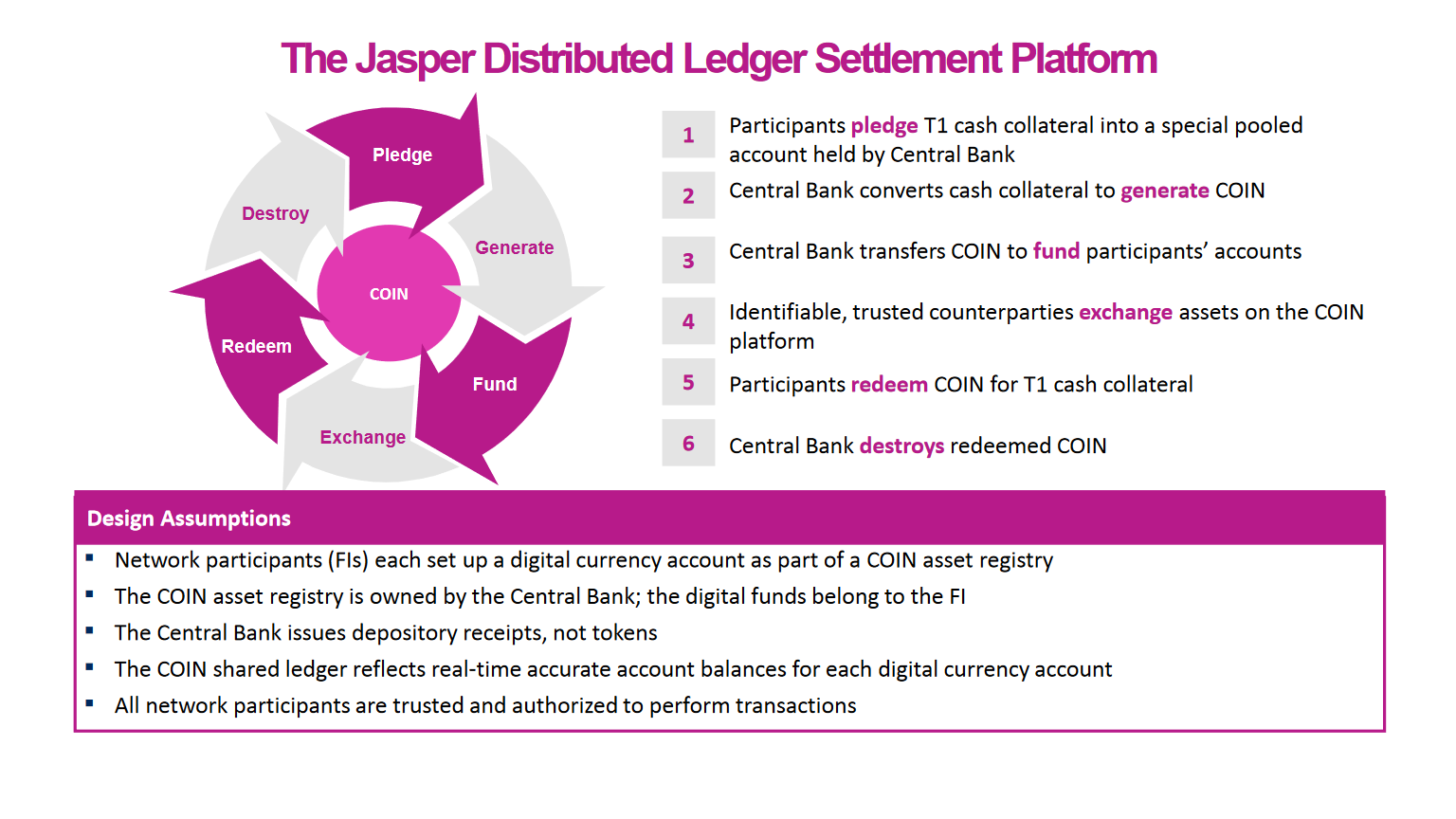

The Bank of Canada began Project Jasper, the bank’s experimentation with blockchain payments, back in June. With the collaboration of Payments Canada and R3CEV, the project looks to simulate wholesale payment system using a blockchain settlement asset.

According to the bank, the project had two objectives. First, to see how the test system could meet international standards for systemically important payments infrastructure. Second, to collaborate with the private sector on a concrete blockchain application.

Image credit

Image creditSo far, the bank has revealed several insights pertaining to blockchain technology:

- Costs savings likely won’t come from using blockchain itself, but from reducing intermediary reconciliation efforts.

- The ability to build other applications on top of blockchain has the potential for more savings.

- Though blockchains reduce the concentration of risk through decentralization, a certain amount of centralization would still be required if applied to wholesale payments systems.

“The Jasper experiment is helping us [to] better understand the business imperative of those who provide and use financial services. It is crucial that financial institutions, new entrants, and policymakers to work together to unlock the full promise of fintech.” —Carolyn Wilkins, Bank of Canada

Curtis added to this list with some words of advice.

“Blockchain is valuable when you have the core fundamental notion of a business network.” —Curtis Miles, IBM

Gold on the blockchain network

The Royal Canadian Mint and Goldmoney entered a collaboration last December in an effort to add the Mint’s Ottawa vault to the Goldmoney Network. This partnership enables Goldmoney users to purchase any amount of 100% reserved physical gold in the Ottawa vault—using Goldmoney’s blockchain technology—and get some storage.

According to Goldmoney, its users can also send gold title to anyone via text message or e-mail, redeem their gold balance to a Goldmoney Mastercard Prepaid card or bank account in local currency, or make vault-to-vault gold transfers between the Royal Canadian Mint and seven Brink’s vault locations located around the world—via a web or mobile app.

“Through collaborations of this kind, we’re creating innovative ways to match supply and demand of precious metals while further expanding the utility and capabilities of the Goldmoney Network.” —Josh Crumb, Goldmoney

Given the origins of blockchain, the most evident use cases still come from the finance industry. Canada’s financial institutions are all over the place when it comes to adoption of the technology and already they are finding success. With continued efforts in the blockchain space, we can only assume that more organizations, not just in finance, will follow suit.

Related reading

- Blockchain Can Help Banks to Better Manage the Identity of Customers

- Hyperledger’s Fabric Composer: Simplifying Business Networks on Blockchain

About the speakers