Building Stock Trading Strategies: 20% Faster with Hadoop

Speeding up a stock trading platform

Based on complex mathematical algorithms, automated stock trading solutions take into account hundreds of factors and suggest the right time for placing buy/sell orders. Some of the systems like that can even make a deal without any human involvement. However, if an algorithm omits essential market parameters, this may bring a significant loss.

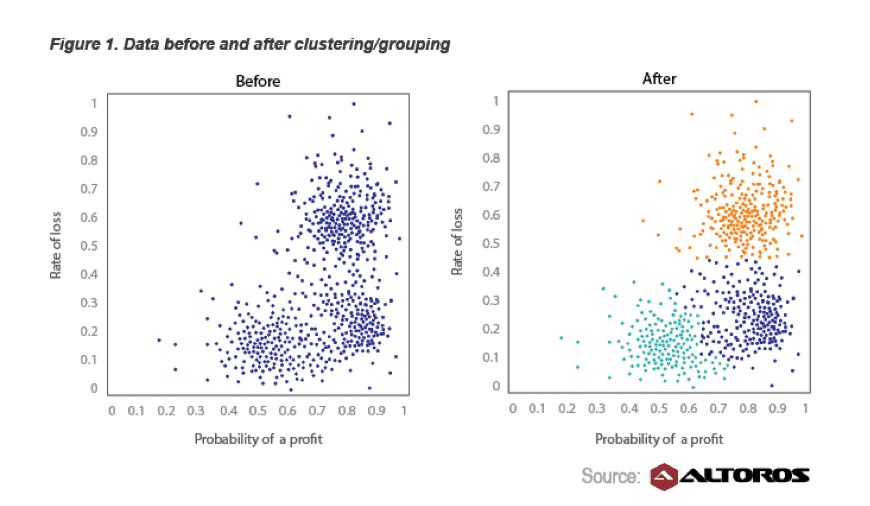

Clustering/grouping trading strategies with k-means

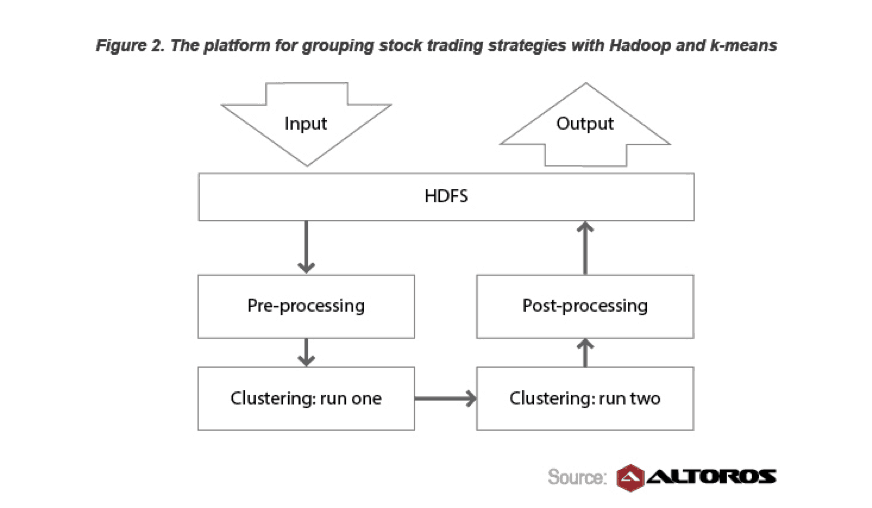

Clustering/grouping trading strategies with k-meansIn this guest blog post, experts at Altoros shared a real-life example of how Hadoop and data clustering speeded up stock the performance of a trading system by 20% and increased customer’s revenues by 12%.

Improving the trading system with Hadoop and k-means

Improving the trading system with Hadoop and k-meansThe article also explores how data clustering helped to diversify sell/buy strategies, and how the right infrastructure can improve the system’s performance without additional investments.

Further reading

- Hadoop Distributions: Cloudera vs. Hortonworks vs. MapR

- Hadoop + GPU: Boost Performance of Your Big Data Project by 50x–200x?

- Hosting a Big Data Meetup: Hadoop on Windows Azure from Microsoft Firsthand

About the author