Blockchain to Add More Transparency to Over-the-Counter Trading

What is over-the-counter trading?

In a nutshell, over-the-counter (OTC) trading is the buying and selling of assets or commodities in private deals. The trades are commonly achieved through two methods: OTC brokers (middlemen) and trade platforms or desks (such as Coinbase, Blockchain Markets, or Circle). In both methods, OTC trades are conducted either through phone or digitally, removing the the need for any physical location. Compared to dealing in exchanges, OTC trades offer more liquidity and have a smaller impact on the market, because they are not publicly recorded.

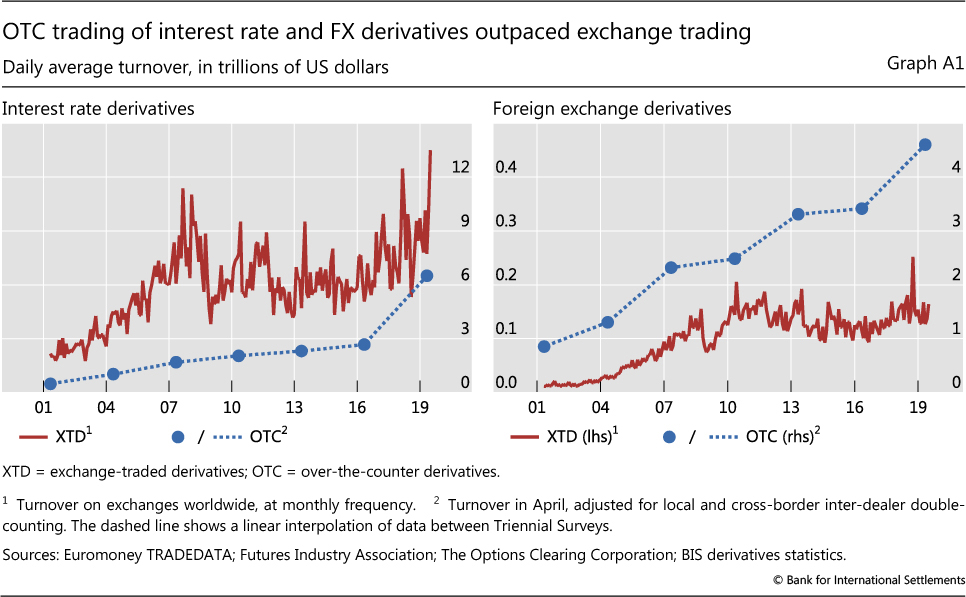

OTC trading, especially for cryptocurrency, is rising in popularity as more and more individuals and organizations invest in digital currency. In April 2018, Bloomberg published a report claiming that anywhere from $250 million to $30 billion were traded in OTC markets daily. The report also indicated that while cryptocurrency prices were declining in both OTC markets and exchanges, the latter experienced a bigger loss as prices in exchanges were down by 80% since its peak.

Transactions shift to the OTC market (Image credit)

Transactions shift to the OTC market (Image credit)However, such trades—particularly those done through OTC desks—require a much larger minimum value to trade (e.g., Circle has a $100,000 minimum). In addition, most of them have restrictive trading limits. For example, Coinbase has a $25,000 daily purchase limit, while Circle has a $3,000 weekly withdrawal limit.

As with other exchanges, OTC trading will often mean having to deal with slippage. (This is when the delivered amount after the trade is vastly different to the expected amount due to market volatility.) At the same time, OTC trading faces its own issues—during Hyperledger Global Forum 2018, Greg Skerry of Altoros provided a brief summary of them.

Challenges with over-the-counter trading

Many problems associated with OTC are similar to any other form of trading or to activities involving financial transactions. However, the rise of cryptocurrencies and improved anonymity urges the industry to seek new approaches and solutions. To sum up, major problems with OTC trading are as follows.

- There are no settlement guarantees if you trade through a broker and the broker’s customer doesn’t pay.

- Limited or no custody solutions (definition) incur both settlement and operational risks.

- There are no clearing platforms that could provide a structure for trading between counterparties. Without a trade structure, additional confirmation of concluded deals between traders are often necessary.

“With over-the-counter trading, we’re losing a lot of the efficiencies and scale of centralized markets. Proposing and structuring trades are done over traditional means of communication. These types of trades are customized directly between counterparties.” —Greg Skerry, Altoros

- With the private nature of OTC trades, malicious or fraudulent transactions are difficult to identify. Transactions do not appear on an exchange, keeping the traders anonymous, as well as avoiding any influence it may have on the value of the asset or commodity.

- No shared records keeping—the lack of standard systems makes it difficult to verify data and / or create a history of deals useful for market analysis. Therefore, this will require a lot of manual work to be done.

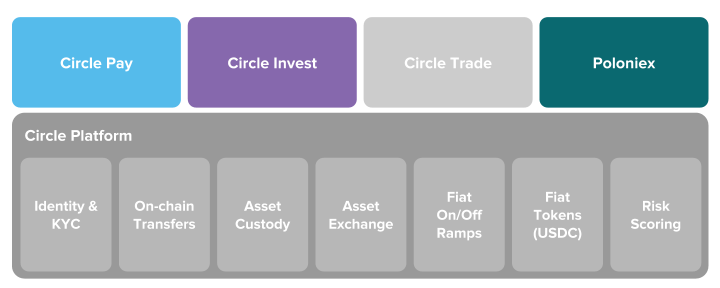

Many of these issues stem from a lack of transparency and a common ledger. In response, many OTC desks, such as Circle and Coinbase, have started developing their own solutions. For instance, in May 2018, the Goldman Sachs–backed Circle officially completed its acquisition of SeedInvest, an equity crowdfunding platform that connects startups with investors online.

The features of the Circle OTC trading platform (Image credit)

The features of the Circle OTC trading platform (Image credit)While OTC desks are creating their own solutions to address the challenges mentioned, many of these are still under development. A standard framework for resolving the issues is also lacking.

“Over-the-counter trading is basically the peer-to-peer analog of centralized exchange trading.” —Greg Skerry, Altoros

How can blockchain help?

As many of the challenges faced by the industry come from a lack of transparency and automation, blockchain seems to pose a viable solution to address them. Powered by blockchain, an OTC trading platform would feature:

- Smart contracts that automate and speed up slow operations, such as custody and settlement processes. Automation is key for certain OTC markets, such as derivatives where trading is completely manual.

- A common ledger that is both immutable and transparent, which all traders can check. This shared ledger provides an accurate history of trades, which can then be used for market analysis and monitoring.

- Authentication of trade offers and bids can be achieved using a trader’s digital signature. An added layer of security is crucial when identifying potentially fraudulent trades, which often occur when large exchanges are hacked, according to a report by Reuters.

- Confidential trades can be verified without having to reveal all the details of the transaction by engaging privacy concepts, such as zero-knowledge proof (ZKP). Authenticating trades in this manner enables OTC trading platforms to process transactions where traders require a level of privacy.

Many cryptoexchanges are already integrating blockchain to improve their OTC platforms. For instance, Dunamu, the operator of global cryptocurrency exchange Upbit, will use blockchain to automate the process of updating shareholder lists, according to a report by The Korea Herald. Prolitus is another cryptocurrency exchange, which leverages blockchain to provide its users with automated trades with smart contracts, as well as a graphical user interface with a dashboard and trade trends.

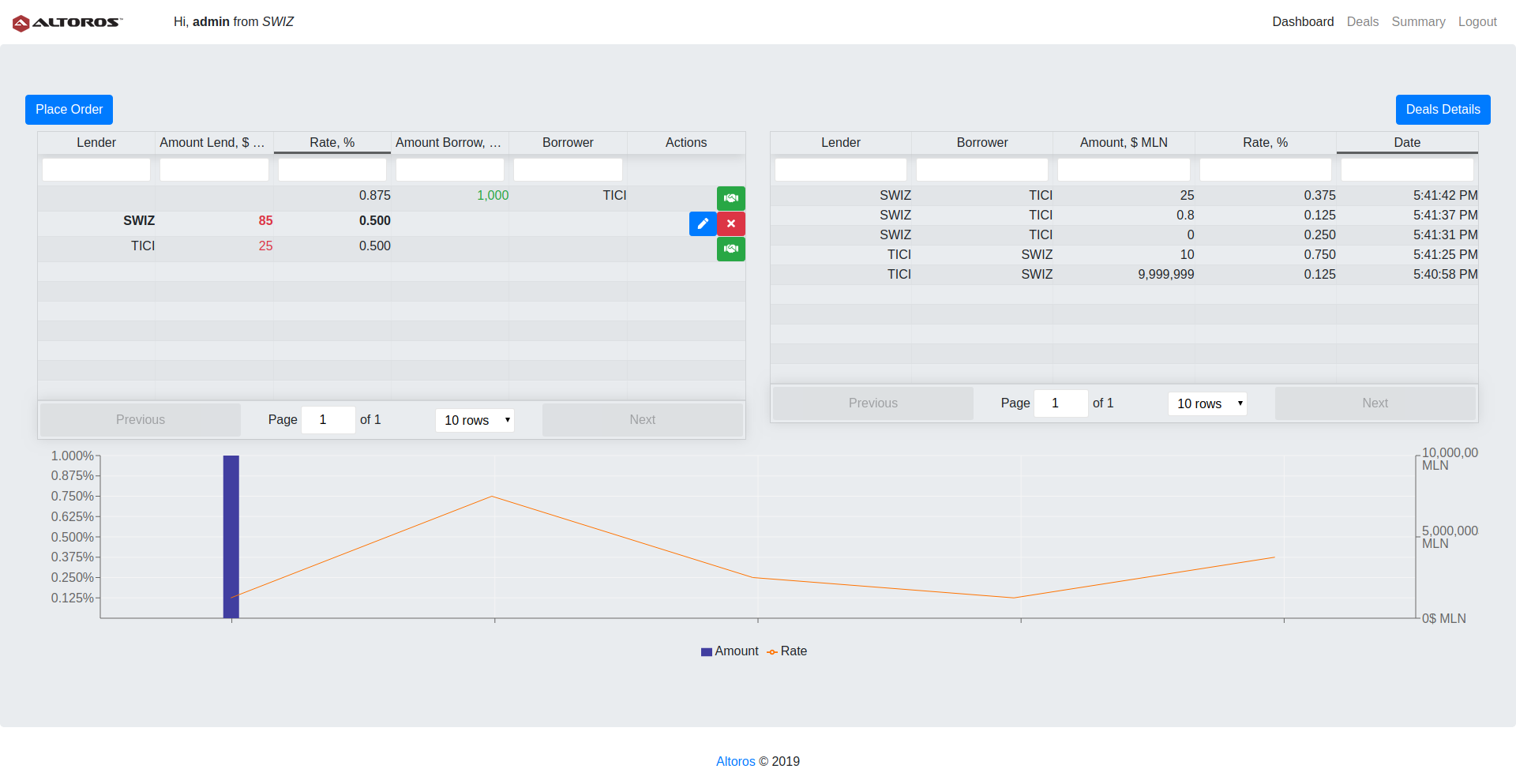

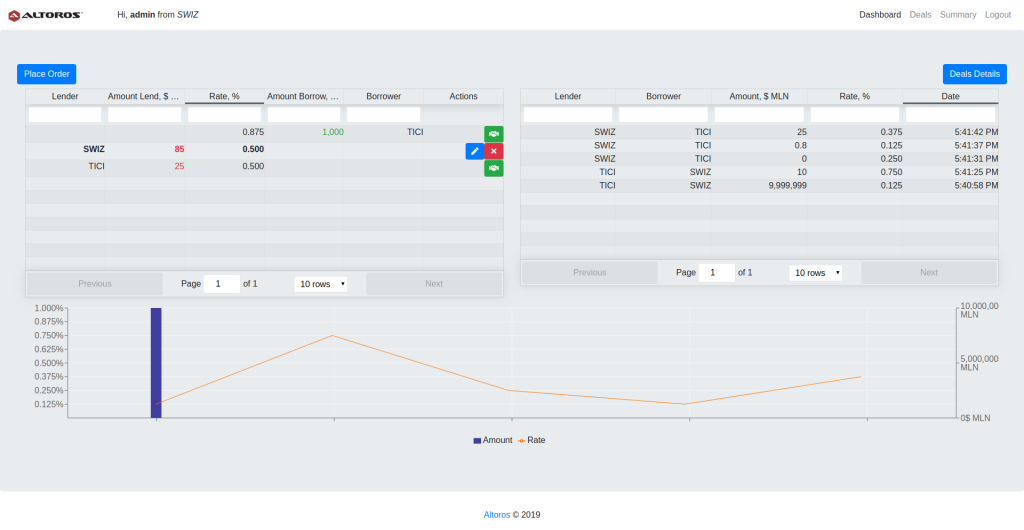

Altoros has also developed a platform secured by blockchain, digital identities, and ZKP to enable transparent OTC trades. The systems aims to address all of the challenges mentioned above and enables real-time monitoring with different dashboards to give companies a comprehensive view of their transactions on a blockchain.

A dashboard of the OTC platform created by Altoros

A dashboard of the OTC platform created by AltorosWith a Kafka-based ordering service on Hyperledger, the platform has a configurable structure, enabling multiple parties to be part of different layers in various channels.

“We don’t want a centralized model, OTC trades are already peer-to-peer. We want a decentralized framework that can provide a lot of the automation and scale that you get with centralized exchanges to the peer-to-peer OTC trading market.” —Greg Skerry, Altoros

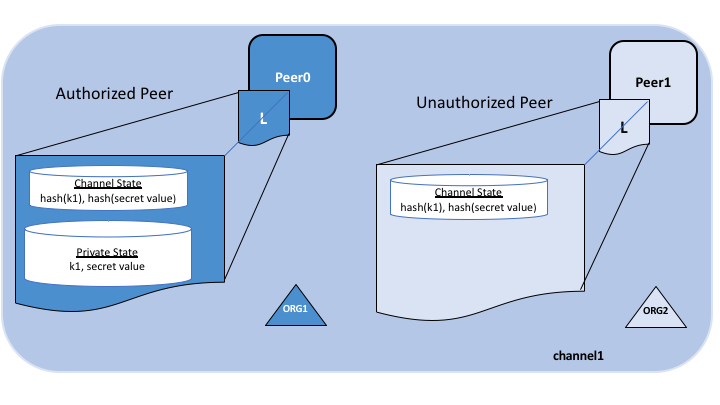

Protecting sensitive data with private collections

What else can be done for the privacy of transactions in addition to the standard traits of any blockchain network? Just like the solution from Altoros, an OTC trading platform developed with Hyperledger Fabric can benefit from private data collections. This feature was introduced by the Hyperledger community to save organizations the pain of creating a separate channel for restricting sensitive data to certain parties.

In addition to hiding all the information related to a particular transaction, private collections allow for limiting access to just a portion of data, while the transaction itself is still visible to all channel participants. A collection comprises two components:

- The private data itself, which is sent peer-to-peer via the gossip protocol only to those to organizations who are authorized to see it. This data is stored in a separate private database on the peer (sometimes called a “side” database, or “SideDB”). The ordering service is not involved in the process and, therefore, cannot see private data.

- A hash of private data, which is endorsed, ordered, and written to the ledgers of every peer on the channel. The hash serves as an evidence of the transaction and is used for state validation, as well as may be employed for audit purposes.

The ledger contents of peers authorized and unauthorized to access private data (Image credit)

The ledger contents of peers authorized and unauthorized to access private data (Image credit)The network participants with access to the data stored as a private collection may share it with others in case of a dispute, for instance, or if they decide to transfer some assets to a third party. In such a case, the third party will compute the hash of the private data to see if it matches the state on the channel ledger and get a proof that the state previously existed.

To further explain how private collections work, consider a simple scenario where three traders are interacting with each other through a unified dashboard. The Hyperledger Fabric network is then deployed in three physically separated instances corresponding to individual traders (no centralized deployment is involved). Traders can see the current interest rates, which can be changed, propose, and accept the deals that are then written into the ledger. Traders can only see the deals they are actually participating in. Any commodity can be added to the network for trading.

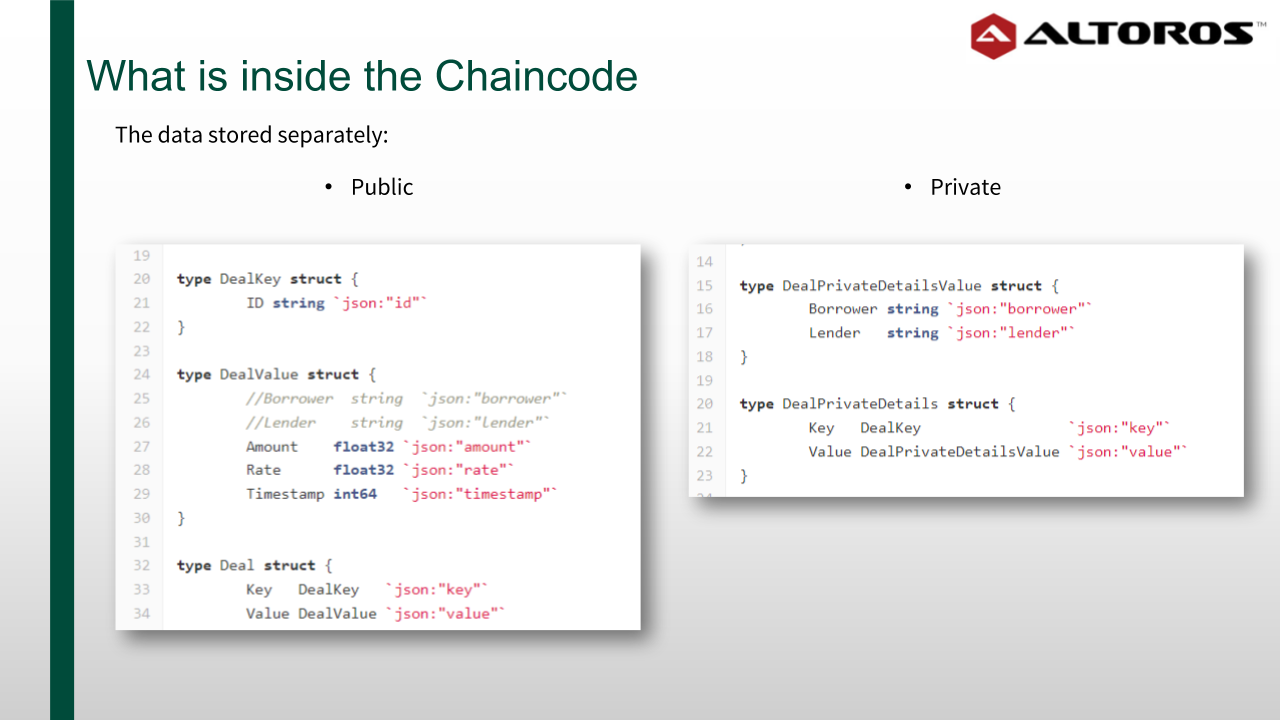

To obtain the data stored in the ledger, a trader has to initialize the query function, which invokes public data stored in the common channel and private collections. In the earlier versions of Hyperledger Fabric, all the data was stored together, while version 1.2 stores public and private data separately.

Private and public data stored separately in Hyperledger Fabric

Private and public data stored separately in Hyperledger FabricPublic data is queried first, this way the chaincode learns who the creator of the specific transaction query is and checks what kind of private collections are accessible there. After the private data is pulled from the collections, it is merged with public data by the transaction ID into a final report.

For more information, refer to the Hyperledger documentation, explore this OTC solution, or check out the videos below.

In the past two years, we’ve seen how industries bogged down by inefficient processes—such as finance and insurance—have found success with blockchain. With some exchanges already pursuing blockchain, OTC trading is following suit.

Want details? Watch the videos!

During a Hyperledger Global Forum session, Greg Skerry of Altoros explains how over-the-counter trading can be improved with blockchain.

In this next video, Vitaliy Chernov of Altoros highlights how private collections work and walks through a chaincode of a Hyperledger-based OTC trading system.

Further reading

- A Blockchain-Based Platform for Automating Bond Issuing Worth $10M

- Managing Risk and Building Trust for Blockchain in Finance

- Blockchain for Insurance: Less Fraud, Faster Claims, and New Models