Blockchain Can Help Banks to Better Manage the Identity of Customers

Understanding customer data in banking

Know your customer (KYC) is a key process in the banking industry, revolving around identifying and verifying the identity of clients. It’s an important issue, particularly in the European Union, where “the right to be forgotten” is a foundation of individual rights.

Vitalii Demianets, Co-founder and Lead Developer at norbloc, led a recent webinar focused on how blockchain solutions can optimize the KYC process.

KYC presents complex challenges

Vitalii described three key issues for banks in building their KYC programs:

- Duplication of efforts. Today, people need to go through the KYC process for each one of their banks, as well as with any particular bank’s subsidiaries in most cases. Conversely, banks need to identify and verify each one of their customers, even if they’ve already been identified and verified by another financial institution. This is clearly a time-consuming, wasteful process.

- Limited digitization. Many banks, “even in very tech-savvy jurisdictions,” Vitalii said, “still use physical forms with the implied administrative and customer burdens.” This is another legacy of a pen-and-paper era.

- Spotty audit trail. “Compliance departments and regulators struggle to identify an impartial and immutable audit trail,” Vitalii said, further adding to delays and expense in a business, where today’s customers expect lightning-fast service.

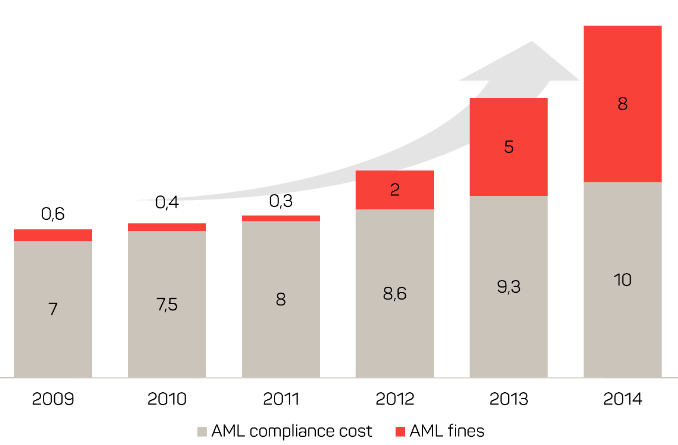

In Sweden, where norbloc operates, big banks may spend US$60 million annually on KYC and related anti-money laundering (AML) each year. Manual labor costs eat up fully 80% of these costs, and paper-based, labor-intensive-driven penalties are approaching 45% of the total budget, Vitalii explained.

Source: Goldman Sachs, Accenture, Celent, Thomson Reuters

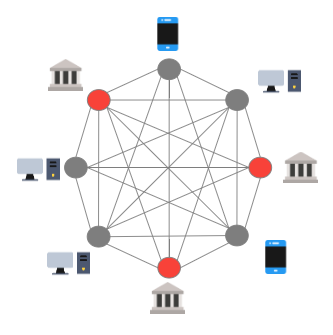

Source: Goldman Sachs, Accenture, Celent, Thomson ReutersSo, blockchain can reduce these costs dramatically, while eliminating the need for third-party intermediaries, and speed things up immensely along the way.

How blockchain can help

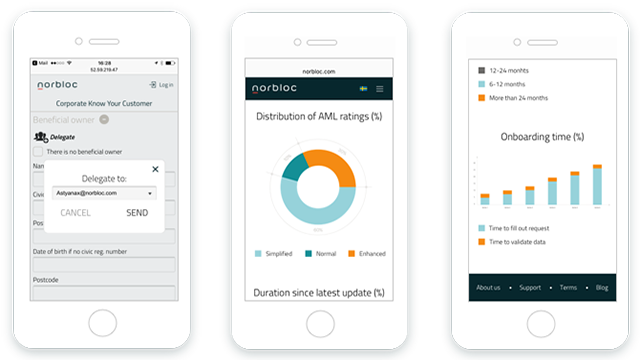

norbloc has worked to develop an “intuitive, multi-platform interface with electronic ID login and APIs to public sources to create a fully digital [customer] onboarding process,” he said. Furthermore, an “encrypted database secured by blockchain technology for 100% availability and irrefutable records of transactions enables real-time reviewing by compliance departments,” he noted.

The blockchain technology “allows for the secure transfer of a KYC verification stamp of one entity to another, as it is unparalleled in distributed version control of ledger contents,” Vitalii explained to webinar attendees. “It offers a highly detailed and immutable audit trail on all actions on KYC files.”

Vitalii noted that his company’s efforts are not focused solely on large, traditional institutions, but also on millions of smaller fintech companies looking to procure a compliant record. In this respect, KYC can change from an expense to a revenue source. According to Vitalii, fintech companies would be very happy to pay a small fee to obtain a compliant record.

“The banks would never sell the data itself, as a customer explicitly gives actual data to an institution, but would sell the digital signatures and therefore stamp of approval. Fintechs will know that (any consequent) customer data is valid and correct.” —Vitalii Demianets, norbloc

APIs, real-time monitoring, and compliance

Some key aspects of creating a successful solution for these banks (as well as those in other countries) include:

- The use of APIs to pre-populate data fields from public data sources, such as corporate registries.

- Collaboration among and within institutions to collect data.

- The customer’s ability to change access rights and have full control over permissions to each field of the data package.

When things reach the compliance stage, “an institution’s compliance department and regulators can have real-time monitoring and reports through a separate interface,” according to Vitalii.

“(Blockchain) enables a full data trail through detailed timestamping and version control, and an audit file on blockchain records all metadata for potential review.” —Vitalii Demianets, norbloc

Vitalii noted that a customer interface needs to accommodate desktop and mobile devices, and norbloc is creating a key management system that manages private keys on customers’ behalf. He said banks must have a permissiond blockchain like Hyperledger Fabric (rather than a public, permissionless platform such as Ethereum). Though Hyperledger’s community support is not as extensive as those of the permissionless platforms, it is strong enough, he said.

“Blockchain is only a means to an end,” according Vitalii Demianets. However, it can serve as an important means, as he outlined a full-bodied solution for financial institutions developed by his Swedish-based company.

Looking forward to version 1.0

The norbloc’s team is looking forward to the product’s version 1.0, which will allow the integration of transient data that complies with the right to be forgotten. Vitalii said by consulting with more than 50 bankers and regulators, as well as a legal firm, he believes blockchain can successfully address the KYC market in Sweden or elsewhere.

norbloc is using Hyperledger Fabric v0.6 as it moves to “alleviate most of the key challenges of the existing KYC process,” he said. The company is testing its solution with six financial institutions in Sweden, and plans to migrate to version 1.0 when it becomes available.

Yet, blockchain understanding has a long way to go, “especially within the business and regulation segments of financial institutions,” according to Vitalii. “There is still ground to be covered in educating people.”

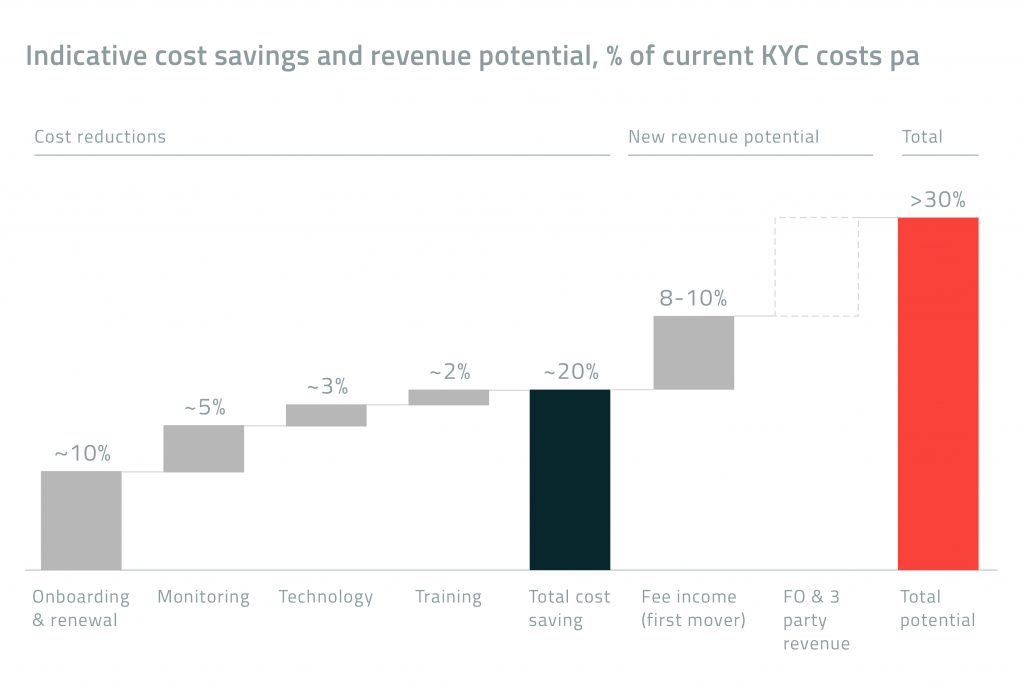

Potential savings for banks using a blockchain solution for KYC

Potential savings for banks using a blockchain solution for KYC“Nevertheless,” he said, “the business side of financial institutions want a problem solved efficiently and effectively, and in our opinion blockchain is the best database choice for this application.”

Want details? Watch the webinar recording.

Related slides

Further reading

- Blockchain for Trade Finance: Real-Time Visibility and Reduced Fraud

- Managing Risk and Building Trust for Blockchain in Finance

- Hyperledger Requirements and Adoption Bottlenecks in Finance and Real Estate