A New Era of IT: Blockchain Efforts Forge Ahead

Current interest in blockchain indicates we may be in the early stages of the greatest Information Technology transformation in any of our lifetimes. However, this potential revolution faces much greater obstacles than prior revolutions.

Blockchain’s originators seem bent on creating a world free of pesky institutions and governments regulating what they want to do. These are self-defined libertarians, even anarchists, who fight the status quo.

Meanwhile, mainstream blockchain development at the moment is being conducted by big financial institutions and their technology suppliers. Rather than fighting the status quo, these companies define it.

Inertia and angst

The political subtext acts as a multiplying effect on the normal institutional inertia that resists change. Government leaders and global institutions across the world loathe the idea of something that can exist without their control, and even within the mainstream developers there is a fear that blockchain has the potential to disrupt them right out of business.

Why all the angst? Isn’t blockchain nothing more than the latest-gen database? Forget about changing the world, does it even represent as profound a change as the RDBMS (relational database management system) revolution of a generation ago that brought structure to data, or the more recent NoSQL databases designed to handle new types of unstructured data?

At least two people think it is significantly more than that. Blockchain can “transform the economic power grid and the old order of human affairs for the better,” according to the recent book The Blockchain Revolution by the father-son team Don Tapscott and Alex Tapscott. “It may create a world where billions of excluded people can now participate in the global economy and share in its largesse.”

Ethereum and Hyperledger focus on the practical

For the present moment, though, both of the best-known open-source blockchain initiatives—Ethereum and the Hyperledger Project—are focusing on practical matters.

As an example, Vitalik Buterin, Ethereum’s co-founder, said in a recent podcast he’d like to see Ethereum be “more generic, and make use cases more generic. The principle here is there are no features, no transaction types for registering an asset, transferring a domain, etc. Whatever app you want to build (on Ethereum) you just write the code.” He said he’d also like to see more non-currency or “semi-financial” use cases.

Hyperledger pushes on consensus and validation

Meanwhile, within the Hyperledger Project, there are detailed, ongoing conversations focused on the issues of consensus and validation. There will also be a Hyperledger hackathon on October 1-2 in Amsterdam, where members of the community can test the feasibility and practicality of their ideas.

Creation of Hyperledger use cases are expected to pick up speed once a dedicated working group develops an architecture that will enable private transactions. In this vision, private transactions are propagated, encrypted, and stored on the blockchain, thus preserving details of business contracts.

Only designated nodes called endorsers are able to decrypt, execute smart contracts and update the state of the ledger. Limiting the number of nodes executing a contract and seeing the data comes at a price of losing resiliency and censorship resistance.

For example, in open blockchains like Ethereum or Bitcoin it is impossible to subvert the majority of nodes because there are many thousands of nodes executing contracts.

The “miners” in public blockchains like Bitcoin or Ethereum win contests to determine specific transaction hashes and create blocks. The successful miner is rewarded with a coin when it wins a contest by solving the puzzle first. Bitcoin is now old enough that it takes about 10 minutes to create a new block, with tremendous computing resources throughout the world devoted to the task. Trillions of hashes per second are tried.

Creation of Hyperledger use case are expected to pick up speed.

Miners listen in on transactions, ensure their validity, execute small instructions in Bitcoin or smart contracts in Ethereum, then pack them into blocks and chain them together. If a miner were to add an arbitrary (i.e., false) transaction, it would create a fork and that miner would have to win every subsequent contest to keep this view alive, something that is surely impossible.

New world of permissioned architecture

Contrast that to the new, permissioned architecture of Hyperledger, in which a limited number of permitted nodes may, in theory, conspire against another member. However, permissioned also means trusted, and members of these networks are expected to behave.

Even though permissioned blockchains are often expected to serve competing institutions, such as the R3 network of more than 40 banks, there is little to no danger of a rogue node highjacking the blockchain. It’s in all members’ interest to keep things running without hitches, and an attempt to create a fork can be dealt with by other members, who all know one another. Hyperledger “miners” are thus known as “validating peers.”

The reward is a smoothly functioning network. Taking blockchain beyond cryptocurrencies means an expectation of vastly more frequent, fast transactions, and the relative ease of transaction validation on the permissioned networks being built for these applications is a critical aspect of them.

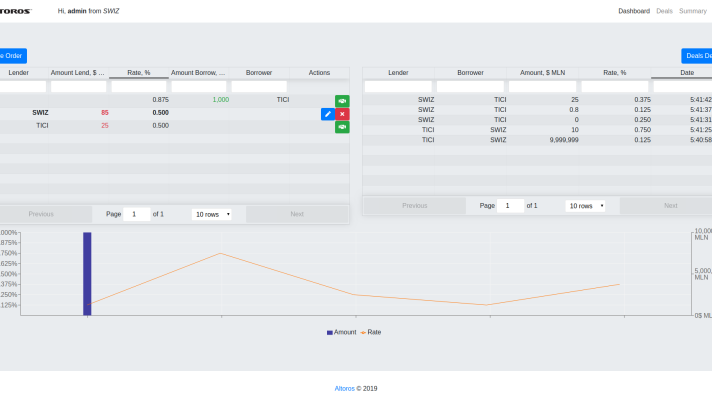

That said, Oleg Abdrashitov, who is working with Altoros on the Hyperledger Project, reports that performance is not the main issue at the moment, but privacy. Peers can read the input to transactions and execute smart contracts to validate them, which means all participants know the dealings of each other, which is unacceptable.

So current efforts are underway to designate peers to validate specific transactions, according to Oleg. “If two parties enter into a confidential financial contract they can designate that only these parties and perhaps other trusted nodes like regulators are allowed to read the input and endorse the transactions. The confidentiality is then achieved, at the expense of resiliency.”

Trust is built into Hyperledger efforts. A limited number of participants—say a dozen or so large banks—join together to swap currencies and settle diverse stock and commodities transactions. The reward is not a bitcoin but a cheaper, disintermediated transaction.

Eliminate the middleman

We’ve been trying to “eliminate the middleman” for decades, and especially since the advent of the Web. Remember the idea of B2B markets, such as Commerce One? The notion was to provide an open environment of all suppliers in a particular industry, thus providing buyers a transparent, full-information environment. They would no longer have to labor to get bids, knowing that in many cases they wouldn’t get the best prices.

The concept failed to gain traction because suppliers balked. The idea clearly ran counter to their ability to retain margins and profits, but it also elevated price as the sole criterion for B2B buyers. Major B2B issues, such as supply-chain logistics, nuanced product options, and the general issue of trust were not part of the concept.

Now, with blockchain, price again becomes a primary focus in that the concept of removing third parties promises large cost reductions. Trust is built in, and the services provided by third parties (transaction validation and execution) are handled by the blockchain.

Key insights from Hyperledger white paper

A white paper developed by a working group within the Hyperledger Project outlines some key points. Even though Hyperledger is in the process of moving its documentation and notes to the Gerrit project hosting platform, extensive source material can be found on GitHub:

Some of the key passages in recent Hyperledger documentation follows:

- “The key motivation for the next generation is modularization to achieve plugability and concurrency. We want to enable different implementations to plug in at different points, including consensus, storage, and membership services. We can achieve concurrency at endorsers and consenters based on the transaction endorsement policy. The new architecture offers great flexibility in deployments.”

- “As the current generation, the simple one-peer development environment, where a developer may quickly iterate over edit-compile-debug of the fabric code or a chaincode, is still intact. What change are the varieties of network deployment options, from a simple network of a few peers to a complex hundred of peers with different configurations possible.”

- “Conceptually, a peer may perform all the functions (submitting, endorsing, ordering, and committing transactions); this is called full peer, or peer. A partial or light peer may perform a specific task like consensus (ordering transactions) or a combination of submitting, endorsing, and committing transactions. A member of a network generally owes a peer and/or some light peers. Currently, we have two types of peers: a validating peer (VP) and a non-validating peer (NVP). We may roughly think of a VP as a full peer and a NVP as a light peer with submitting and committing tasks.”

- “Consensus service. Consenters may independently operate to form a consensus network, isolating from the other peer functions (submitting, endorsing and committing transactions). This capability allows the members to set up a consensus network such that it can serve multiple blockchains, which only need to deploy light peers (without consenter enabled). The consensus network can be agnostic to the transactions enabling data isolation such that submitters may replace the transaction payload with its hash.”

- “Calling another chaincode with security: we currently have chaincode calling chaincode locally but without security. Security means both access control and transaction confidentiality, which means whether the person being called is visible to the caller. Multiple confidential domains complicate the picture, so the first implementation should focus on chaincode calling chaincode within the same confidential domain. Calling a chaincode in the “public” domain should allow only queries since changes to a chaincode state requires a transaction visible to that chaincode’s endorsers.”

- “Support calling external APIs (public or protected) from inside chaincode without introducing non-determinism. Blockchain networks rely on an “oracle” role to accomplish this. In addition, in V2 architecture, the submitting peer can make the API call once during transaction simulation and pass the resulting data along to endorsers, which will not need to call the APIs again (which would introduce non-determinism). This provides an additional (simpler) route when the submitting peer are trusted by the endorsers.”

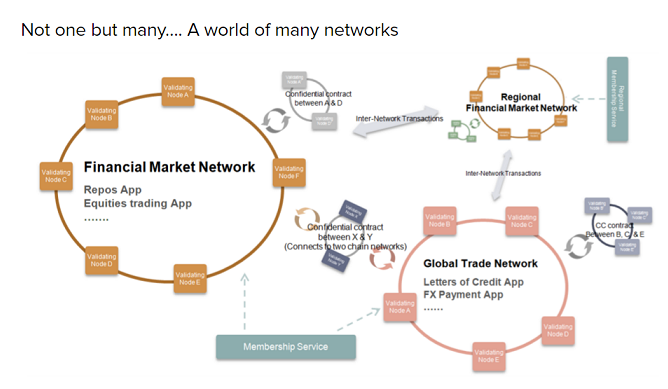

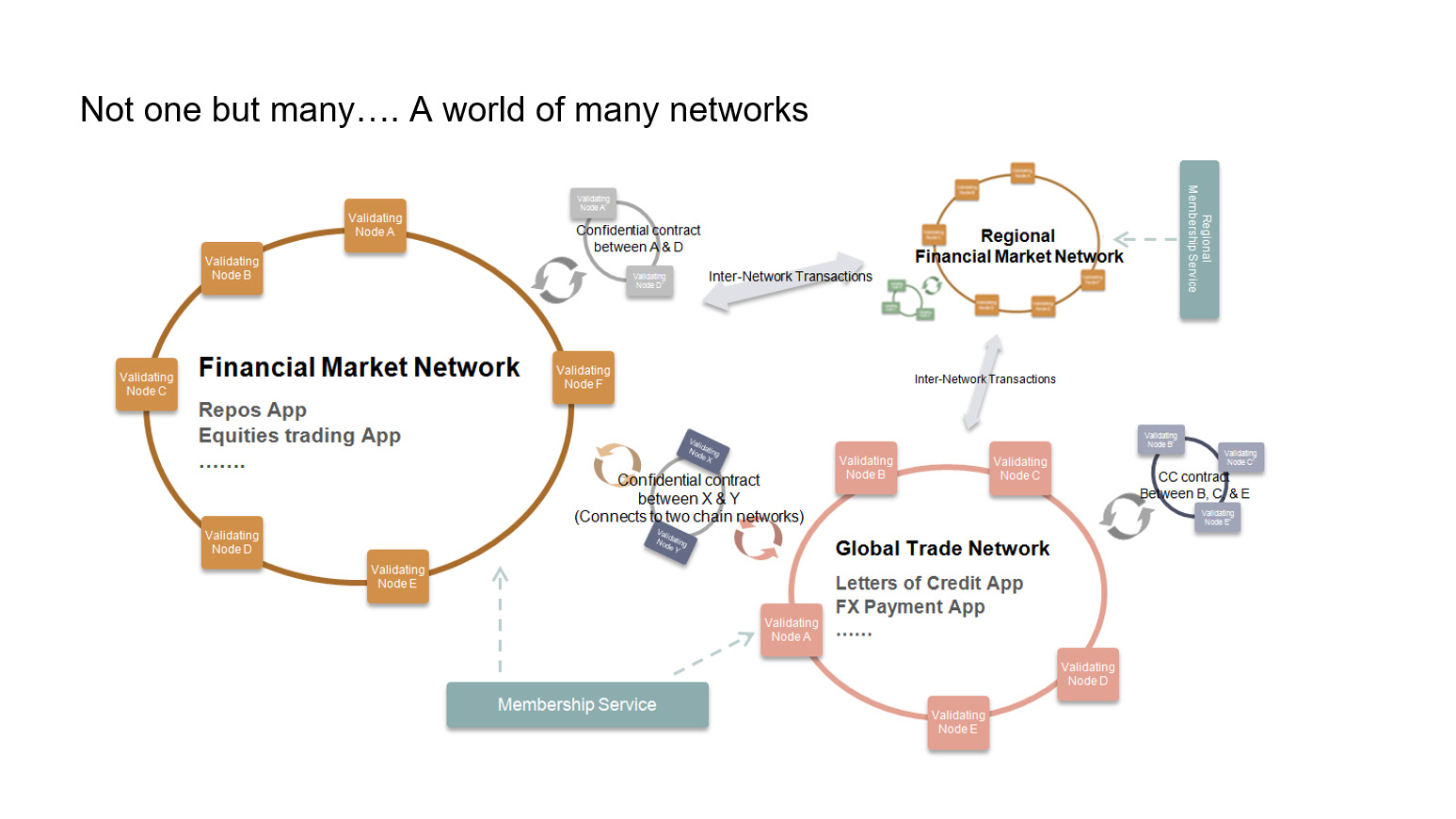

As all this develops, Hyperledger developers are keeping in mind that blockchain is likely to encompass a network of networks, as illustrated below:

Source: The Hyperledger Project

Source: The Hyperledger Project

New projects announced

Blockchain projects seem to be proliferating. Here are just two recent examples:

- A new company in Singapore called Attores is working on a PoC for a blockchain that handles smart e-contracts. Company CEO and co-founder David Moskowitz says Attores will have templates for things such as tenancy contracts, rental agreements, and employment contracts.

- In Southeast Asia, a London-based blockchain startup called Provenance has run a pilot project to test sustainability claims. The company is developing an open, grassroots method for doing so throughout supply chains, it says. The pilot project tracked yellowfin and skipjack tuna fish from Indonesia—the world’s largest tuna-producing country—“from fisherman to factory” in an effort to incentivize ethical labor practices, environmental preservation, standards compliance, and the eradication of fraudulent reporting.

“Provenance was established to enable transparency of key social and environmental indicators along even the most complex chains,” the company says.

The way forward

We are again embarking on a journey through a wormhole that promises paradigmatic change. Schumpeter is quoted, Moore’s Law invoked, while fear, uncertainty, and doubt (FUD) returns to center stage.

In many corners of the world, teams from Ethereum, Hyperledger, the two other projects mentioned here, and no doubt countless others are working to disintermediate operations, secure assets, and perhaps even change the world.

Note: Many thanks to Oleg Abdrashitov for his insight, especially in the sections describing the current state of they Hyperledger Project, and the sections about miners and validating peers.