Blockchain for Insurance: Less Fraud, Faster Claims, and New Models

The burdens of a trillion-dollar industry

In 2015, life and health (L&H) and property and casualty (P&C) insurance combined exceeded $1.2 trillion in net premiums in the US alone. This amount was approximately 7% of the country’s gross domestic product for that year.

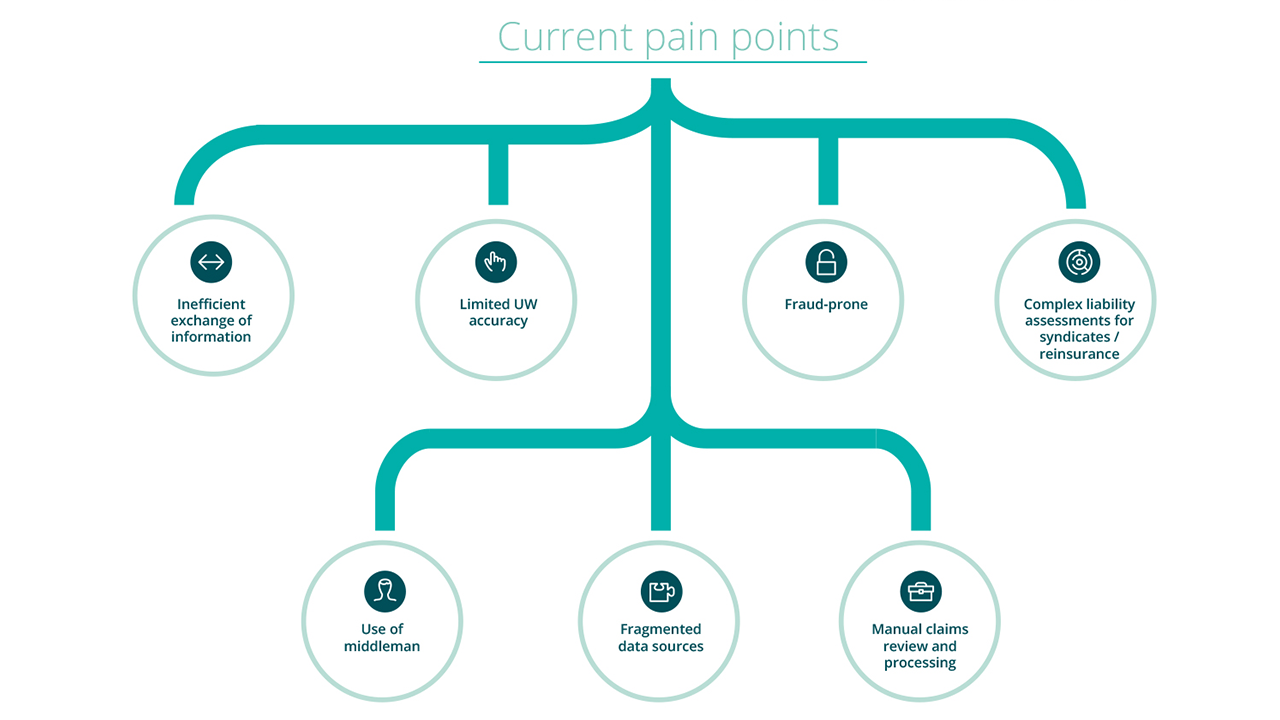

Despite all the money involved and just as in any other business, there are problems in the industry that still cause pain. The most aching ones include inefficient data sharing, fragmented data sources, manual claims review / processing, and fraud.

Among these challenges, fraud is a major problem across all forms of insurance. It drives up the cost for both insurers and policy holders. The Coalition Against Insurance Fraud estimates that over $80 billion a year is lost to fraud.

According to Deloitte, health insurance fraud can come in multiple forms—ranging “from providers submitting claims for services never rendered to up-coding services to receive higher payments.”

Problems in the insurance industry (Source)

Problems in the insurance industry (Source)Fraud may come up at the very early stages—during the application process—in case one glosses over a critical medical diagnosis on his/her record. A person can also commit fraud by withholding information about being on some other insurance plans (that can potentially cover the services used). Or, by filling a claim on behalf of ineligible members/dependents (e.g., using a mutual insurance plan after divorce).

Another problem is that it takes too long for insurance applications and claims to be reviewed and processed—up to several weeks or even months. With the impact blockchain is already having on other industries, such as finance/banking, what can it do for insurance?

Why this happens

A research paper by IBM reveals that the existing methods of storing and reconciling financial data—the pillars of insurance claims operations—are too complex and fragmented. At the same time, organizations that are included in the workflow are reluctant to share their data due to obvious reasons:

- The risk of disclosing information that is easily identifiable to be further associated with a person.

- Sharing data across borders means having to abide by multiple laws and regulations.

- Insurers are unwilling to share sensitive loss information to competitors.

- Some insurers may want a central authority to manage the shared data.

- The free-rider problem occurs, implying that larger organizations contribute more and get less than the smaller ones.

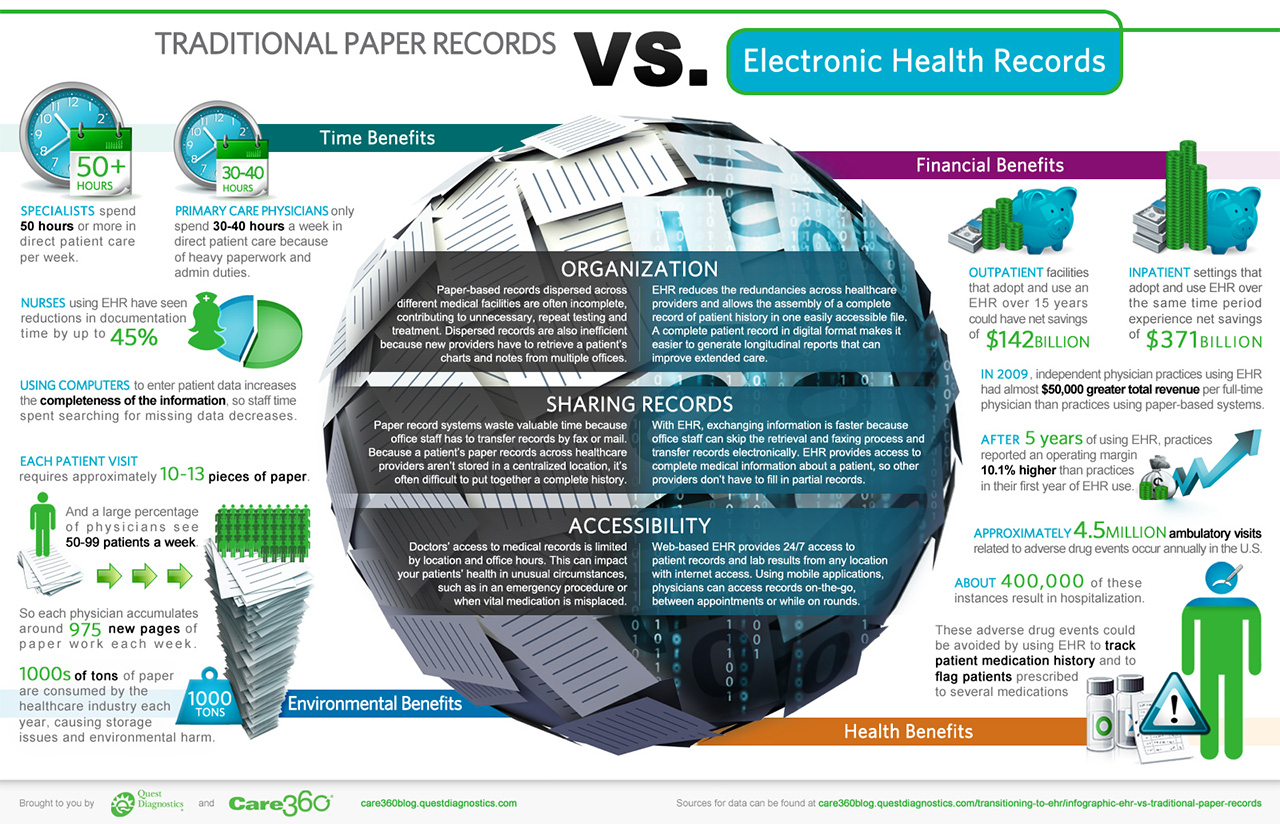

Though such policies as the Medicare Access and CHIP Reauthorization Act (MACRA) are seen by governmental institutions as a means to enable interoperability, insurance providers experience certain difficulties—imposed by workflow issues and vendor costs/capabilities of the electronic health record (EHR)—when sharing data.

Advantages of electronic records over paper (Source)

Advantages of electronic records over paper (Source)In healthcare, the sharing of patient information is a big concern. Hospitals would rather keep their own data to comply with the Health Insurance Portability and Accountability Act (HIPAA).

As a result, criminals use the reluctancy of organizations to share data for the advantage of their own. There are certain gaps in visibility that cheaters are well aware of and so, as IBM wisely remarks, “the bad guys know more than the good guys.” The examples include the usage of the same device to create multiple policies or the usage of the same patterns in multiple claims across insurers by the same or different people (e.g., text phrases or rings).

Finally, relying on manual data processing and verification results in delayed application approvals and claims operations.

Mitigating fraud and securely sharing data

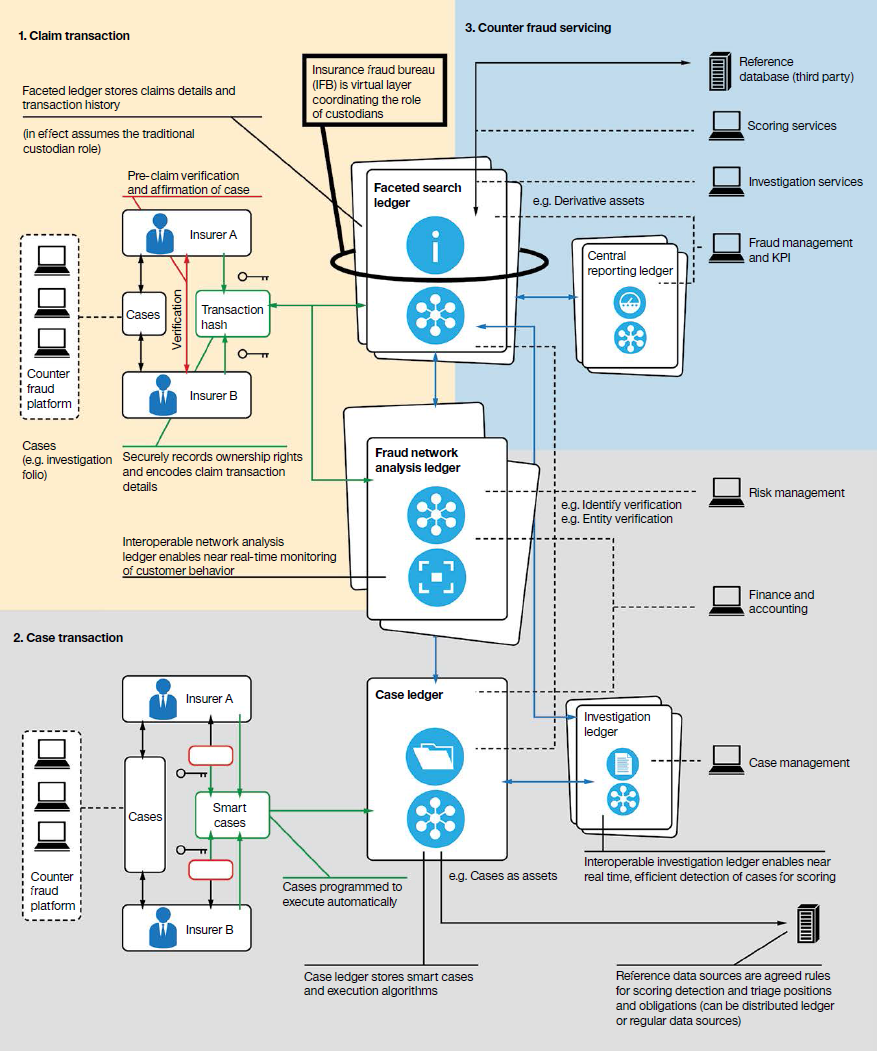

A potential remedy to mitigate fraud is to enable secure sharing of data and intelligence among insurers. In this case, blockchain becomes an ideal candidate due to its decentralized model, immutability, and transparency. The technology’s permissioned approach to data access becomes key to the privacy of shared information.

A counter-fraud architecture with blockchain suggested by IBM (Source)

A counter-fraud architecture with blockchain suggested by IBM (Source)Blockchain can minimize counterfeiting, double booking, document, or contract alterations. The technology may enable insurers to create receipts at any stage of the claims process, while ensuring an immutable and auditable record of all the claims activities. Thus, all the participants can get a “distributed, single view of the entire exposure data chain.”

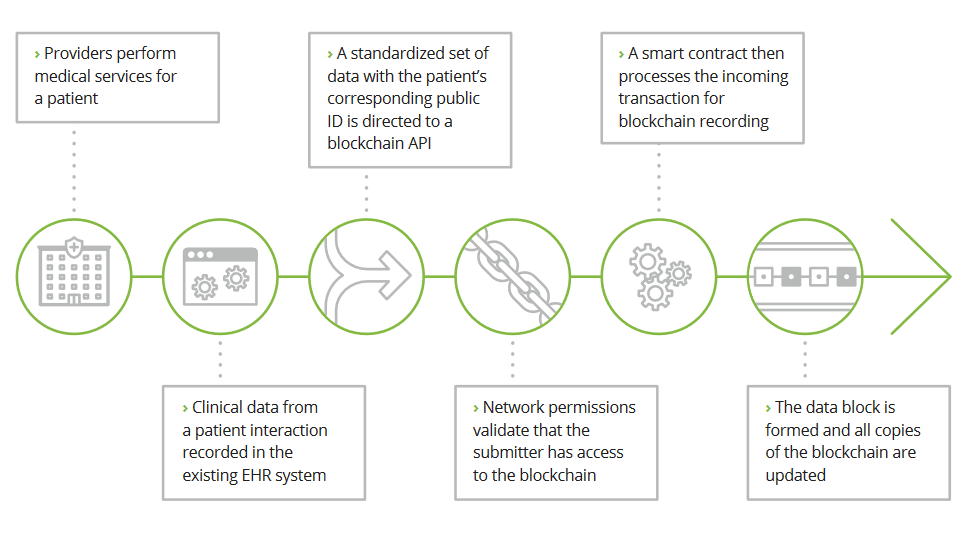

Using blockchain, healthcare organizations can safely share data to create a comprehensive electronic healthcare record for all patients. Patients and other authorized users can then provide private keys to give access to physicians and insurers to ensure data security.

A potential roadmap for writing medical data on blockchain (Source)

A potential roadmap for writing medical data on blockchain (Source)Being one of the fastest adopters and developers, Estonia’s healthcare system is already powered by blockchain. Different healthcare providers across the country come together on the blockchain network to provide a common record for each individual patient.

Automated claiming and application processes

In addition to improving security while data sharing, blockchain can play its role in automating and streamlining insurance processes.

Deloitte attributes long application/claiming cycles to inefficient information acquisition, processing, and sharing. Their report mentions that the slow propagation of information is because “many insurers are using claims systems that were originally built more than 30 years ago.” This issue also makes it hard for insurers to maintain their systems and adopt new strategies.

In this scenario, blockchain can enable insurers to:

- Automate information collection and processing through smart contracts

- Improve data access and visibility

- Lower overall cost due to faster transactions and processes automated by smart contracts

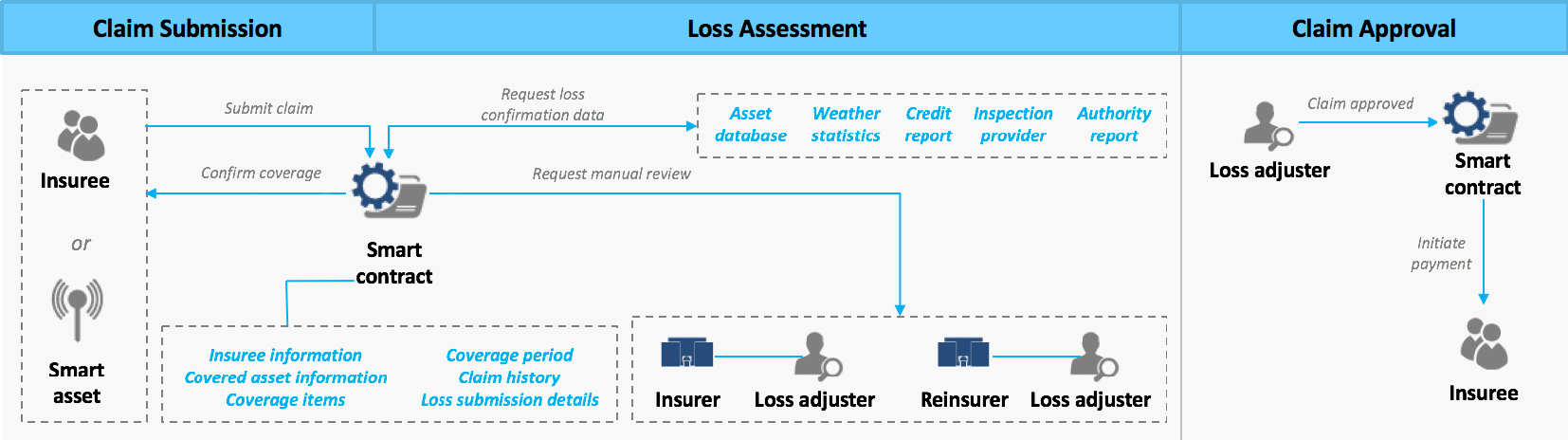

Smart contracts automating the claiming process (Source)

Smart contracts automating the claiming process (Source)Going back to healthcare, any reduction to overhead costs can help insurers reach a required medical loss ratio (MLR) as mandated in the Affordable Care Act. Making use of smart contracts to automate information collection also removes any delays, ensuring shared healthcare records are kept up-to-date.

As Deloitte puts it in the report, “with the entirety of a consumer’s medical and wellness records consolidated in a series of blockchains, the life insurance underwriting and application process could be whittled down from an average 45 days to near real time.” Having healthcare records on a blockchain saves much of the tedium involved with applying for life insurance, as well. Insurers can simply verify data on blockchain to approve applications in real time. This eases the pain applicants usually go through with gathering and submitting current information.

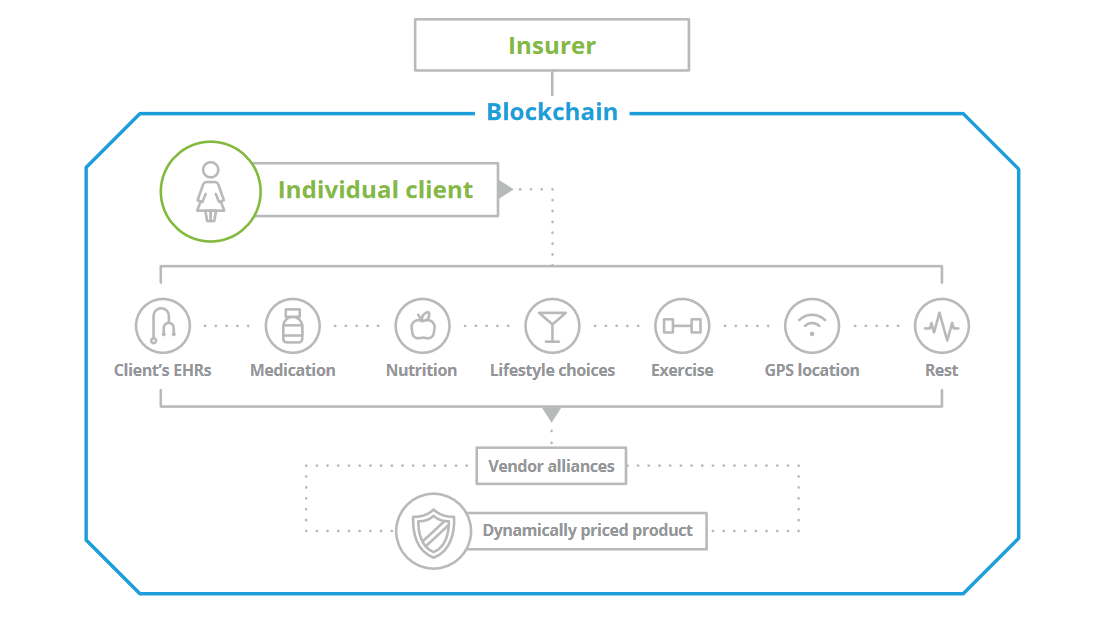

Yet, another aspect where blockchain may be of use is dynamic insurance pricing. The same way car insurers take into account a driver’s age or a number of accidents, there is a set of similar criteria for health insurance, as well. With automated blockchain, it becomes much harder to provide false information.

Customized pricing with the help of blockchain (Source)

Customized pricing with the help of blockchain (Source)Blockchain may aid insurers in accumulating all health-lifestyle data, coming from multiple sources, in a single place to be further updated in almost real time, while enabling more frequent risk reassessments and customized pricing.

Insurance across borders

When it comes to insurance, there aren’t that many multinational providers. Typically, insurers operate within a single territory. This is because of the complexity involved in having to comply with the laws and regulations of multiple countries.

Last June, American International Group, Standard Chartered Bank, and IBM took on the challenge of creating a multinational insurance policy using blockchain based on Hyperledger Fabric.

The three jurisdictions were chosen for their market growth and complex regulatory requirements. The collaboration involved converting a controlled master policy written in the UK along with three local policies from the US, Singapore, and Kenya into a smart contract.

The blockchain provides real-time visibility of insurance events (Source)

The blockchain provides real-time visibility of insurance events (Source)Another global initiative in this area is the Blockchain Insurance Industry Initiative B3i. In October last year, Swiss Re, Liberty Mutual, and other major insurance companies joined forces to explore the potential of blockchain. Since then, the initiative has expanded to 16 members.

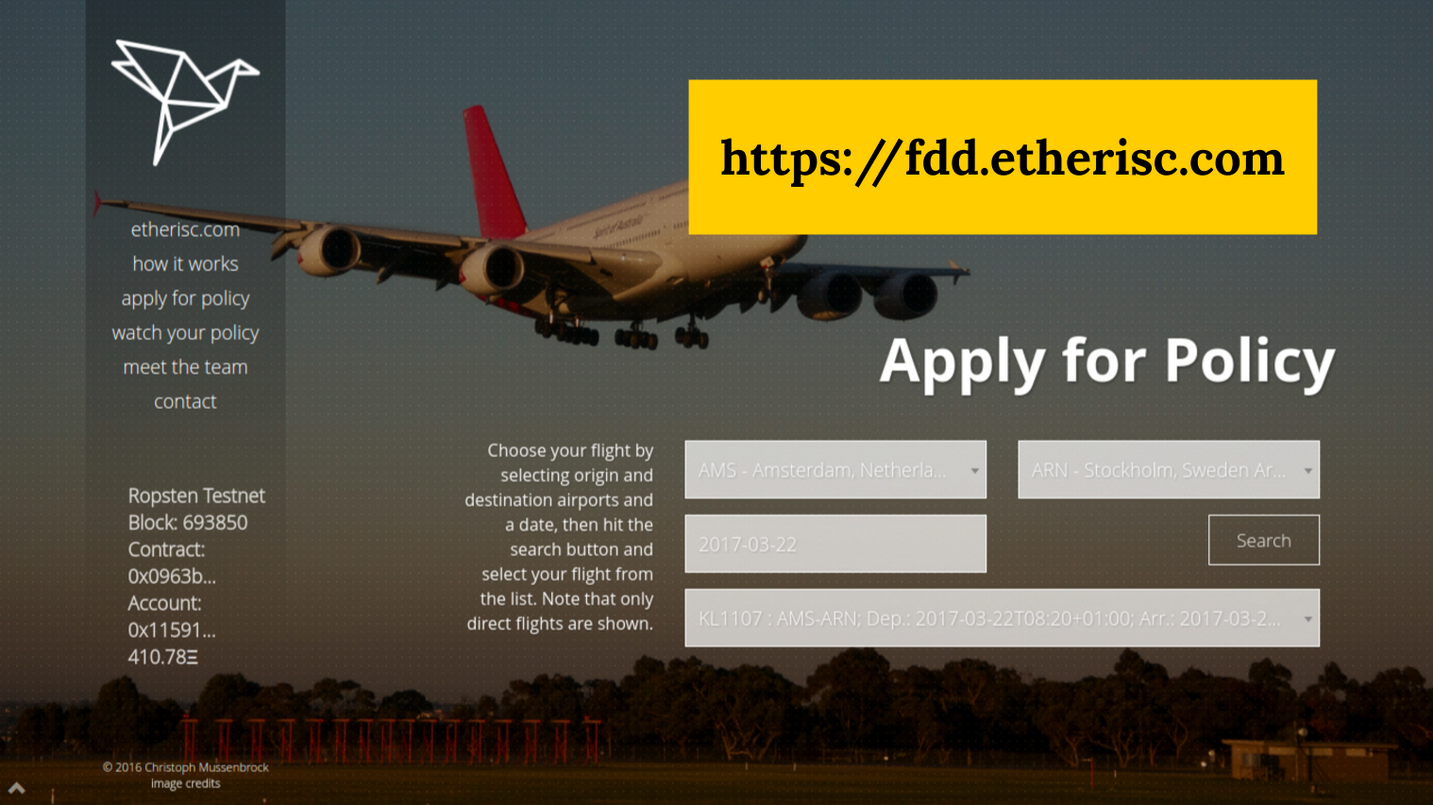

Nevertheless, businesses of different scale are adopting blockchain to deliver insurance products in a new manner. For instance, a very promising InsurTech startup Etherisc has recently launched a blockchain-powered travel insurance app that allows for getting an instant, automated payout in case your flight was delayed or cancelled. The company itself is building DIP—a decentralized insurance platform.

Etherisc’s decentralized app for flight delay insurance (Source)

Etherisc’s decentralized app for flight delay insurance (Source)Another brilliant example is Everledger, which tracks provenance of goods (such as diamonds) beyond borders, ensuring product identification and transaction verification for various stakeholders—including insurance companies, claimants, law enforcement agencies, etc.

What we observe now is while key industry players are still evaluating the pros and cons of blockchain, newcomers don’t hesitate to give it a go in an attempt to disrupt the market. In the Digital Age, there are chances that their new business models—based on a blockchain—may significantly change the insurance landscape soon.

Want to learn more? Download the full research paper on how blockchain can help insurance companies to resolve the existing pain points of the industry.

Further reading

- Blockchain for Insurance: From Preventing Fraud to Automating Claims

- Blockchain for Trade Finance: Real-Time Visibility and Reduced Fraud

- Blockchain Can Help Banks to Better Manage the Identity of Customers

- Canadian Financial Institutions Are Adopting Blockchain: 6 Success Stories