GECKO Governance Unifies Compliance Management with Hyperledger

Onerous compliance environments

Fund managers are a conservative lot, handling as they do many billions of dollars of assets from a wide variety of investors. They are also tormented by onerous compliance environments, and could benefit mightily from a technology that makes their compliance procedures secure, scalable, and immutable.

This is the hypothesis by Shane Brett and Damien Cahill from GECKO Governance, who are putting to use Hyperledger as a technology behind their fund-management solution.

Shane and Damien led a recent webinar, covering the use of Hyperledger Fabric for managing compliance with fund managers and regulators. Shane noted that the world of fund-manager compliance is “amenable to Fabric,” and that GECKO tried out a few other blockchain technologies before proceeding with Fabric.

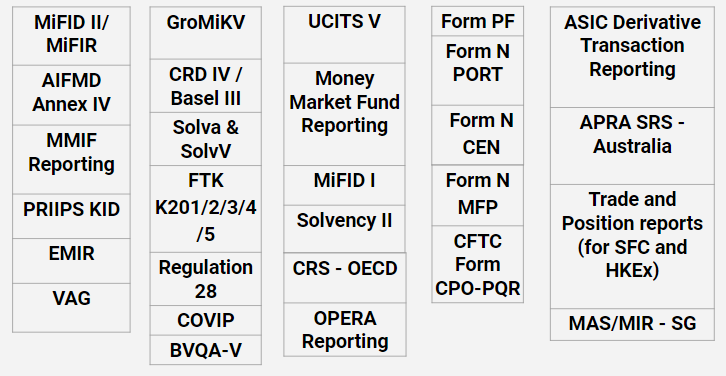

A deluge of regulations

Shane provided a graphic representation of “all the key compliance and regulatory rules and legislation that’s come into place, since the financial crisis of 2008–2009 for fund managers.”

“Deluged with a new wave of regulations, it’s very difficult to comply with these numerous, sometimes contradictory, not transparent, and very expensive processes.”

—Shane Brett, GECKO Governance

He also said that “this is a very high-stakes game,” noting that 40 fund managers in the UK were fined more than $1 billion in 2014 for flouting compliance rules, and some fund managers in the US have been jailed for long terms.

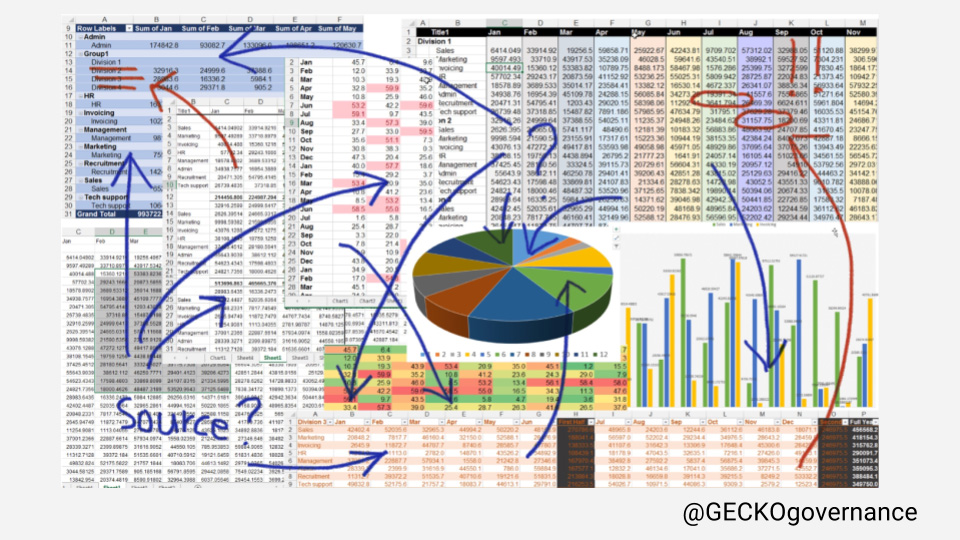

Yet, even in this highly intense environment, the humble spreadsheet has been the technology of choice for fund managers to list their compliance processes. “Spreadsheets are not transparent, not scalable, and not reportable,” Brett noted. So, regulators often have to pay two-week, on-site visits to comb through documents to ensure fund-manager compliance.

An auditable trail of compliance with blockchain

Shane, Damien, and the rest of the GECKO team are working with Hyperledger Fabric to “build a solution that provides one live view of scheduled end-to-end compliance tasks,” according to Shane.

“Fund managers can schedule and report all their tasks and give regulators full access to demonstrate that they are compliant at every stage of these processes.”

—Shane Brett, GECKO Governance

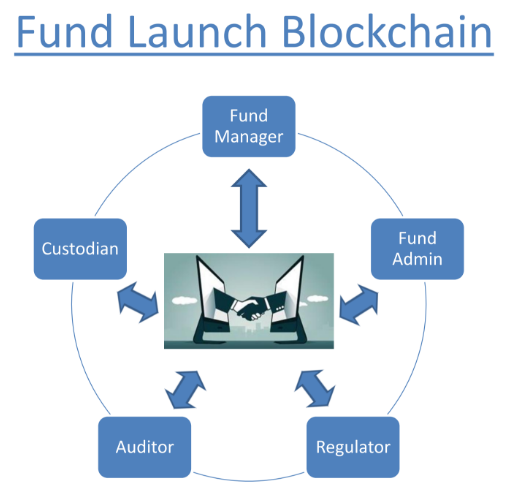

GECKO is taking an approach that takes into account all the parties in this environment.

Shane noted that the regulators themselves have often stepped up in support of a better way of doing things. “Fund managers need a much clearer way to show the regulators that they are complying,” he said.

“It’s not good enough anymore to say you’re compliant. Regulators don’t want to be told, they want you to demonstrate it. With (blockchain and) Fabric, they get a live, secure, irreversible, and auditable trail of compliance.” —Shane Brett, GECKO Governance

Damien highlighted some additional benefits.

“With a permissioned blockchain such as Fabric, the parties have to be invited in. Everyone at least knows one another. Within that, data can be transmitted on a need-to-know basis. Fabric gives the ability to allow others to see the transaction has taken place but not necessarily see whats going on in the background.” —Damien Cahill, GECKO Governance

According to Damien, “with blockchain, you can hold onto information forever, because more than one node has the data. If one goes down, there are others with the information.” Shane then added that UK regulators have set up “a regulatory ‘sandbox’ that allows small companies with interesting technology like GECKO to work in a safe space to demonstrate to the regulator how this new technology meets their requirements.”

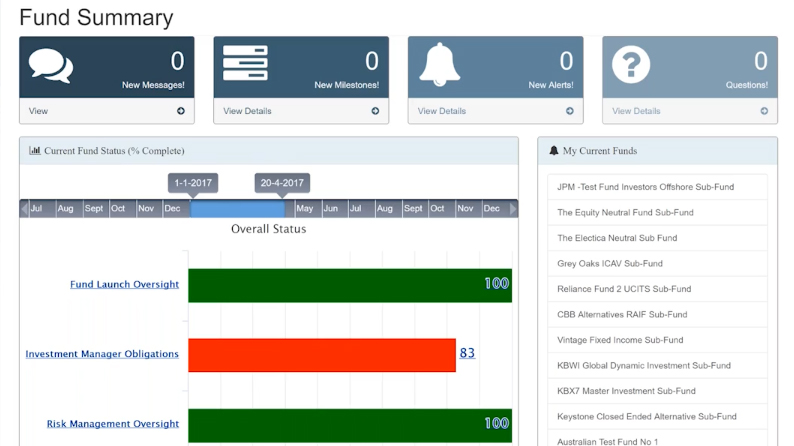

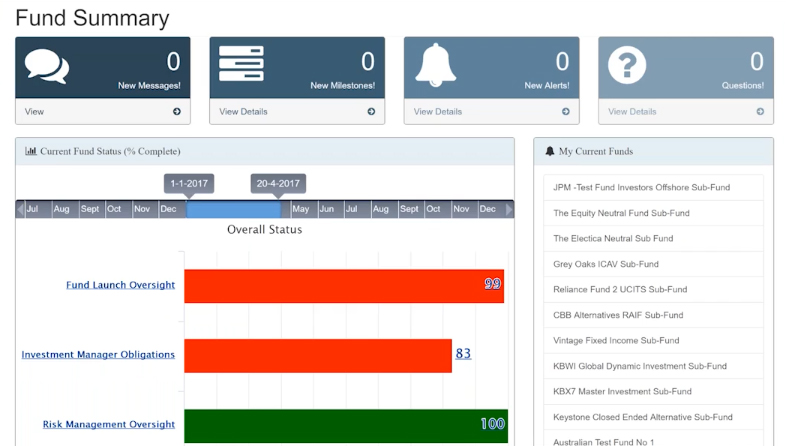

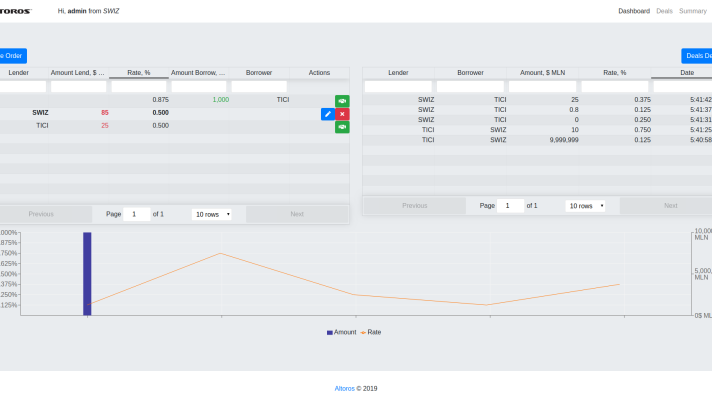

A single-view dashboard in action

A demonstration of GECKO’s approach first showed how specific funds are listed as compliant (green) or not (red):

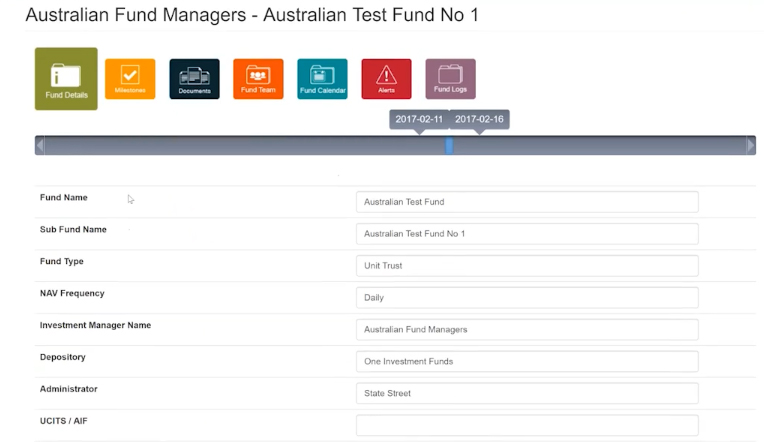

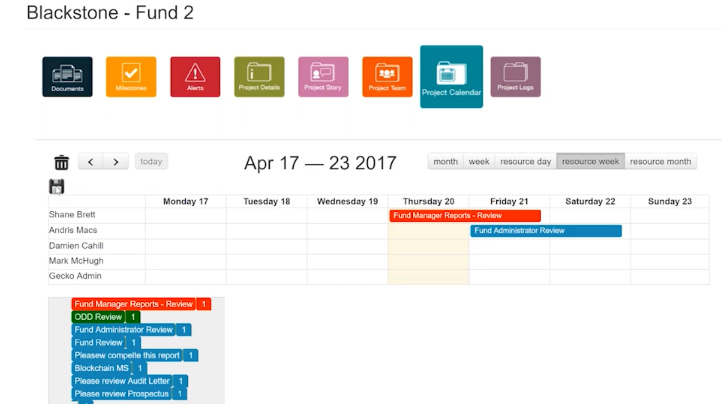

Details of a particular fund can be brought up, as well.

Then, the fund manager can see which aspects of a particular fund are in compliance or not.

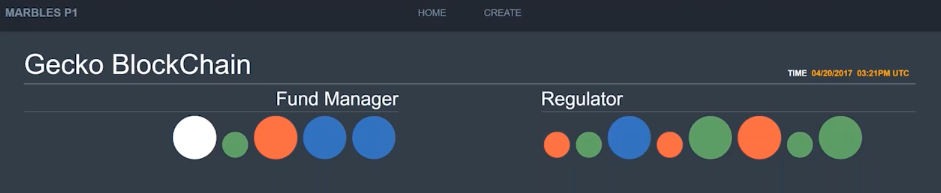

On the blockchain, a green-red-blue schemata lets fund managers and regulators know which processes are in compliance (green), which are not (red), and which (blue) are in progress.

Finishing things off, a calendar function generates a blockchain update, an e-mail to relevant parties, and updates all the relevant calendars, once a process becomes compliant.

“Blockchain audit trail is the future of compliance,” Shane stated. “As fund managers see regulators coming onto the blockchain, that encourages them to come on board, as well.”

Want details? Watch the webinar recording.

Related slides

Related reading

- Blockchain Can Help Banks to Better Manage the Identity of Customers

- Blockchain for Trade Finance: Real-Time Visibility and Reduced Fraud

- The Journey to a Self-Sovereign Digital Identity Built on a Blockchain

About the speakers