Blockchain to Reduce Intermediaries in Many Industries Outside Finance

“The future is billions of ledgers,” according to Michael Mainelli, Executive Chairman of the Z/Yen Group, “(and) ultimately these are just databases.” His remarks came during a recent Hyperledger meetup in London.

Engaged during his long career within the City of London—one of the world’s premier financial centers—Michael noted that companies there are always on top of the latest trends and have been working with distributed ledger ideas since 2010.

Disintermediation has been a goal of business for some time, driven by consumer markets and their unrelenting focus on price. Now, with the blockchain technology, major time and cost bottlenecks are threatened with distintermediation and removal.

Removing monopolies in a supply chain

The role of central third parties dates at least to the Sumerians several millenia ago, Michael noted, stemming from the lack of trust among people when it comes to transactions. Noting that financial services are based on mistrust and leverage of parties against one another, he outlined a few common sins:

- A sin of commission, involving forgery of a transaction.

- A sin of deletion, involving the reversal of a transaction.

- A sin of omission, involving censorship of a transaction.

The first of these involves clearly criminal behavior, the second may reflect a disagreement and/or criminal behavior, and the third involves (often discriminatory) judgments as to whether a transaction is allowed to take place.

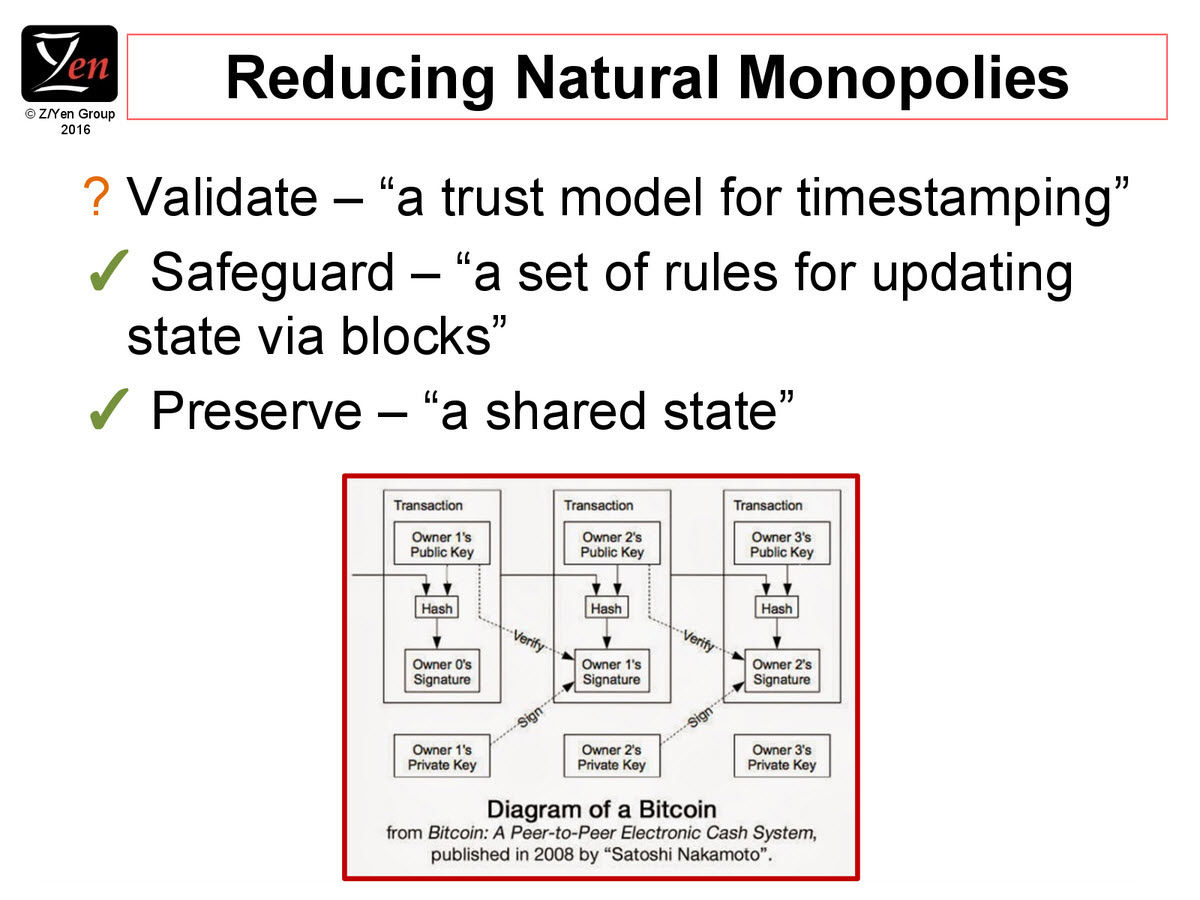

The verified and immutable characteristics of blockchain technology eradicate all of these sins, as well as the third party, reducing the natural monopolies that third parties have enjoyed while also lending new efficiencies along the way.

“The real thrill is reducing (the time for processes) that we would typically handle with workflow.”

—Michael Mainelli, Z/Yen Group

When talking about security challenges, Joseph Pindar of Gemalto also referred to a diagram demonstrated by Michael Mainelli that illustrated the concept of blockchain with a private key as one of the core elements.

“If a bad guy gets your private key, they can sing whatever they want on blockchain on your behalf. And that’s the problem.” —Joseph Pindar, Gemalto

Where can this idea be applied?

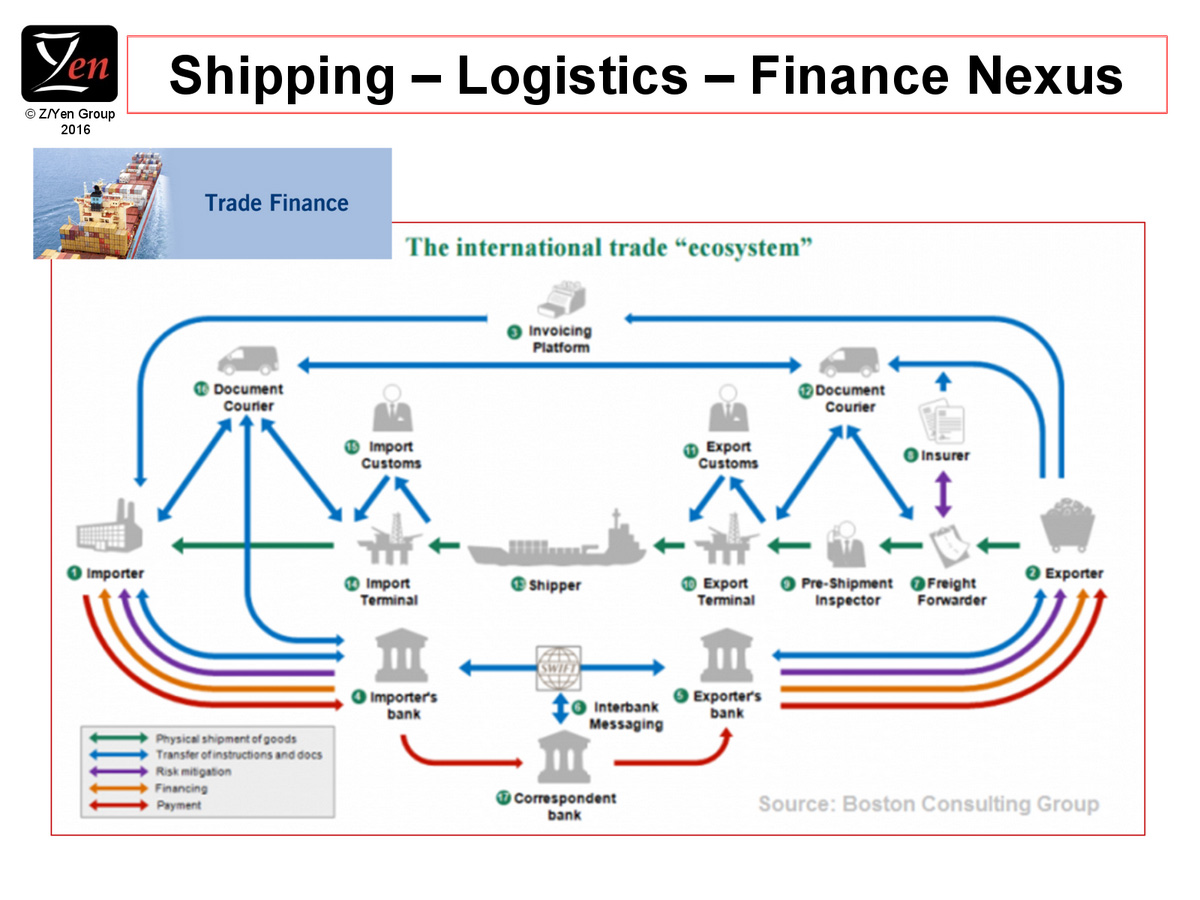

Michael then outlined how some of those billions of ledgers could be created and put into use. Michael noted that there may be as many as 150 documents involving eight to ten entities for a complex contract in the shipping business in which he’s been involved for many years. “(Merely) removing SWIFT costs in this context is irrelevant,” he said.

“The thousands of interactions in moving a vessel are where I see the strength of this technology and its importance.” —Michael Mainelli, Z/Yen Group

Michael also raised the point of removing discriminatory judgments from many types of transactions, something that can impede and even bring things to a stop. The potential time savings should be enormous in the complex, global shipping industry, as well as other supply chains that are essential for most types of business.

Michael noted some other instances and applications where blockchain could be put to use:

- Timestamping and data logging, geotagging

- Clinical trials

- Sharing economy broker and underwriter

- Reinsurance claim payment data sharing

- Retail insurance and wholesale insurance

- XML document engine

- Exchanging KYC and AML docs (Z/Yen created IDchainZ for that)

In summary, Michael noted that “mutual distributed ledgers help communities share information across time and space, less vulnerable to natural monopolies. They also provide persistent and permanent contract utilities, such as safeguarding transactions and preserving transactions and data.”

“Over time, mutual distributed ledger technology will displace much messaging and shared data functions.” —Michael Mainelli, Z/Yen Group

The following recording provides more details on Michael’s thoughts.

Table of contents

|

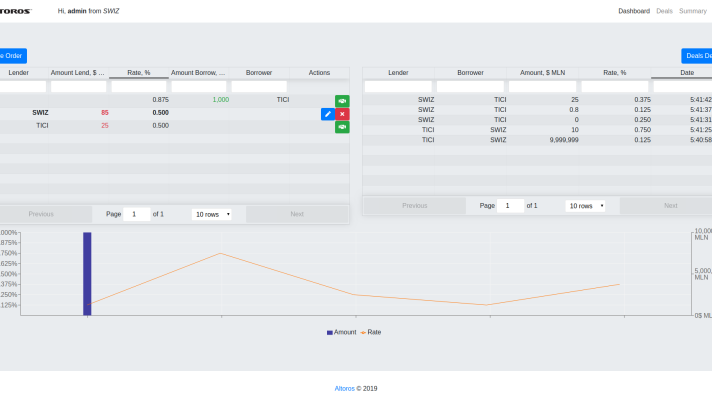

Brackets: Streamlining payment processes

The idea to use “Brackets” to speed up payments along supply chains was the focus of another presentation, made by Skuchain’s co-founders Srinivasan Sriram and Zaki Manian.

A Bracket records the terms of a trade, starting from the purchase order and automatically executes the flow of money based upon signals resulting from the flow of goods. Besides reducing processing costs, this opens up avenues for innovations in finance.

The company’s strategy is driven by the reality of “lots of areas of friction in supply chains and little transparency in certain spots,” Srinivasan noted.

“There are many areas in which money is stuck and (therefore) inventory is stuck.”

—Srinivasan Sriram, Skuchain

Zaki elaborated: “There is a core set of problems, so that it’s not easy for buyers and sellers to interact. (The process) needs payment guarantees and credit insurance, and a third-party is traditionally going to finance it and guarantee it.”

“With blockchain, we can have parties contracting things with privacy, while preserving things with a permissioned blockchain. There is privacy and verifiability with cryptographically verifiable transactions. We’ve embedded our approach into Hyperledger.”

“Blockchain translates normal business interactions into information that allows a financier to make a decision about lending.” —Zaki Manian, Skuchain

Solutions for improving collaborative commerce

In response to this industry challenge and opportunity, Skuchain has developed several products based on blockchain and Brackets to accelerate payments and transactions.

- The Data LC speeds up payment to customers, while providing processing efficiency for banks in the transaction. Through integration with SWIFT rails for LCs the Data LC addresses the adoption challenge for new technology. Specifically, the Data LC allows a Bracket-aware bank to accrue benefits even when the counter party is not Bracket-aware.

- The Blockchain Based Obligation (BBO) provides a purely blockchain-based means for a bank to take on a payment obligation, contingent on trade requirements being met. With the Data LC and the BBO, a Bracket-aware bank can generate new revenue from financing Open Account users. Particularly for the Bank’s customers who are suppliers, use of the Data LC enables them to avail better financing opportunities. For the Bank’s customers who are buyers, use of the BBO allows their suppliers to secure improved financing from the Bank.

- Deep Tier Financing allows highly credit-worthy buyers to lower cost of capital through the tiers of their supply chain. This reduces cost of goods for the buyer while simultaneously granting them deep visibility into their supply chain.

- Cash Flow Scrips are Banker’s Acceptances that can be transferred on the blockchain and enable many interesting applications including Deep Tier Financing.

The following video provides more details presented by the co-founders of Skuchain.